Advertisement

Advertisement

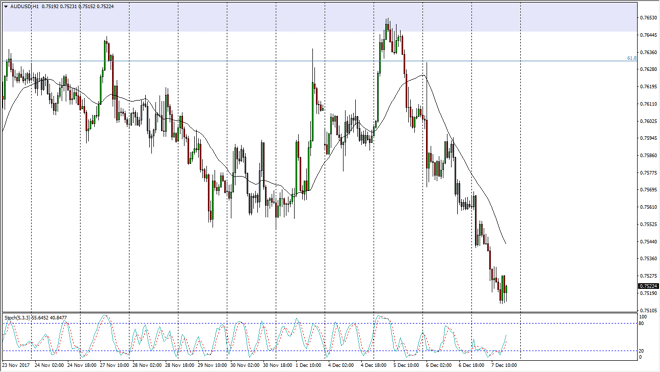

AUD/USD Price Forecast December 8, 2017, Technical Analysis

Updated: Dec 8, 2017, 06:29 GMT+00:00

The Australian dollar has fallen again during the trading session on Thursday, as we await the jobs number coming out of America today.

This pair could be interesting, because if the US dollar strengthens due to strong jobs reporting, we could see this market break down below the 0.75 handle, which I see as massive support. A breakdown below that level is very negative, and it could send the Australian dollar looking towards the 0.7350 level underneath. Alternately, if we bounce from here, I suspect that the move will be to the 0.7560 region, where we would start to see resistance again. We would need to see gold rally significantly, and perhaps even break above the $1300 level to be comfortable buying the Australian dollar, because this market is so highly leveraged to the gold market, which of course has been beaten down.

With the likely raising of interest rates coming out of the Federal Reserve, I believe that the market is more than likely to favor the US dollar. This is especially true considering that the Reserve Bank of Australia has been less than hawkish recently, so I think that rallies will offer nice opportunities to take advantage of the US dollar falling in value. However, we could smash right through the support, which is then a sell signal. At this point, I don’t see me buying the Australian dollar anytime soon, as it is a riskier asset, and I also think that the US dollar is starting to become favored again. At least when it comes to the commodity currencies, that is. We are starting to see a bit of a shakeup around the Forex world, and today could be very volatile and important. Because of this, there are other markets to be involved with that will be easier for what I see.

AUD/USD Video 08.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement