Advertisement

Advertisement

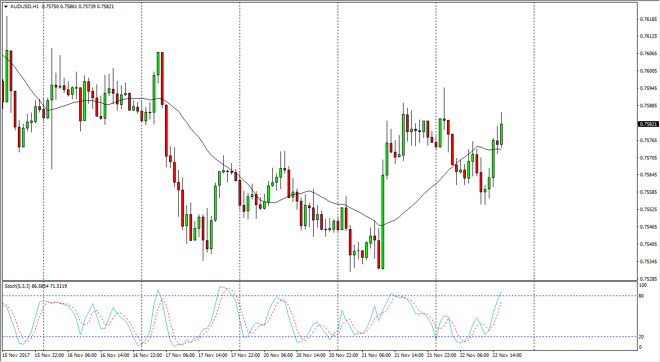

AUD/USD Price Forecast November 23, 2017, Technical Analysis

Updated: Nov 23, 2017, 05:00 GMT+00:00

The Australian dollar initially fell during the trading session on Wednesday, but found enough support near the 0.7550 level to bounce significantly and

The Australian dollar initially fell during the trading session on Wednesday, but found enough support near the 0.7550 level to bounce significantly and reach towards the opening price again. This is looking very much like a market that wants to put a hammer down for the day, and that of course is a very bullish sign. However, I think that there is a significant amount of noise between here and the 0.76 level to cause some issues. A break above the 0.76 level should clear the way to the vital 0.7750 level above, which is the beginning of a massive resistance barrier. And there is the issue, this market has far too many support and resistance levels and a relatively tight range.

Gold markets of course are not helping, they don’t seem to be ready to break out of larger consolidation either, and at this point I think that the Australian dollar may be very quiet over the next several weeks. As we get closer to the holidays, volatility will dry up, as traders will not be looking to put on huge positions before the end of the year. Speaking of holidays, today is Thanksgiving Day in the United States, so I anticipate that the markets will go dead quiet in late European trading as Americans will be away. All things being equal, I suspect that the market will try to make a move towards the 0.76 handle, but will also struggle in that region, and simply roll over for more choppy trading that seems to suit this pair currently. I still think that the 0.75 level underneath is a massive “floor” in the market, and a move below there would be extraordinarily bearish. Short-term range bound trading probably suits this pair the best right now.

AUD/USD Video 23.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement