Advertisement

Advertisement

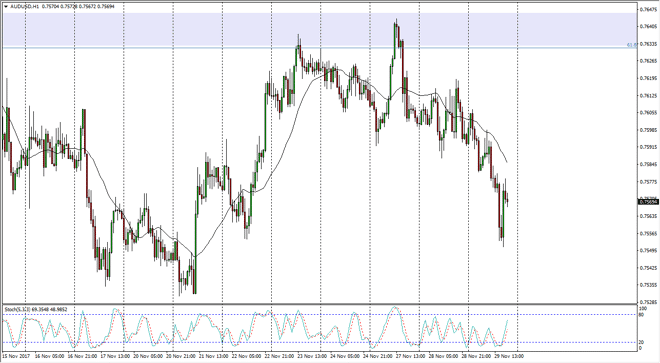

AUD/USD Price Forecast November 30, 2017, Technical Analysis

Updated: Nov 30, 2017, 05:04 GMT+00:00

The Australian dollar fell during most of the session on Wednesday, but did find a bit of support near the 0.7550 level and bounced slightly. However, I

The Australian dollar fell during most of the session on Wednesday, but did find a bit of support near the 0.7550 level and bounced slightly. However, I believe that this market continues to be one that we can sell, and that we are trying to build up enough momentum to finally break down below the 0.75 handle. Once we do, the market should go much lower, as it is a break of significant support. I recognize that the markets continue to be very choppy and volatile, which makes quite a bit of sense as the gold markets themselves have been very tight and noisy. By being tied in noisy, there is no clarity, and it’s difficult for the Australian dollar to follow its lead.

Rallies at this point should continue to find trouble above, especially near the 0.75 handle, where we have a lot of order flow. When you look at the longer-term charts, the Australian dollar is falling apart essentially, and I think that it only lends itself to shorting at this point in time, at least until we see the market break above the 0.7650 level, something that looks very unlikely to happen in the short term. I like the idea of taking advantage of rallies on short-term charts as value in the US dollar, and if we can break down below the 0.75 handle, the market could find itself going down to the 0.73 handle rather quickly.

Pay attention to gold, the $1300 level has been massively difficult, and if we were to take off above there, we could see a similar move here in the Aussie. Until then, I just can’t make the argument for buying the Aussie over the US dollar which has the benefit of having interest rate hikes coming soon.

AUD/USD Video 30.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement