Advertisement

Advertisement

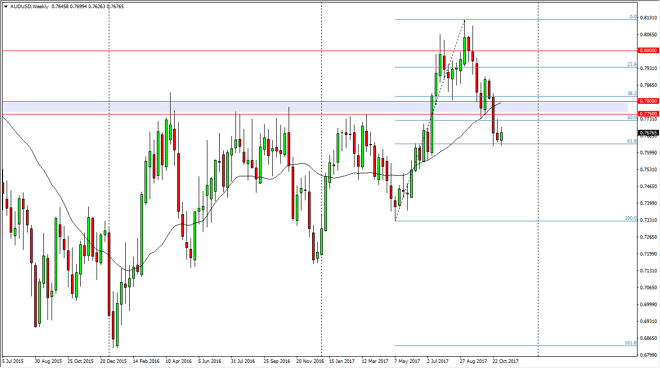

AUD/USD Price forecast for the week of November 13, 2017, Technical Analysis

Updated: Nov 11, 2017, 05:09 GMT+00:00

The Australian dollar rallied during the week, bouncing from the 61.8% Fibonacci retracement level on the search higher. However, the previous candle is a

The Australian dollar rallied during the week, bouncing from the 61.8% Fibonacci retracement level on the search higher. However, the previous candle is a shooting star, suggesting that there is plenty of selling pressure above. Beyond that, there is an area above at the 0.7750 level that extends to the 0.78 handle that should remain very important in this pair. It is an area that has been massively important on the longer-term charts, and the fact that we broke down below that level again tells me that we could see a lot of resistance at that area. Ultimately, if we broke above the 0.78 handle, that could be a sign that we are finally ready to take on the 0.80 level above, which is important going back decades. However, I think we need to get a bit of help from the gold market, as the gold markets have a lot of under the radar influence on this pair.

With the exhaustive candle from the previous week though, I suspect that we are probably going to see this market rollover. If we break down below the 0.76 handle, it’s likely that we go down to the 0.7350 level again, completely wiping out the overall uptrend move that started earlier this year. Because of this, I do favor the downside, but I need to see the breakdown to start throwing money at this market again. The last week candle that formed the shooting star is a very negative sign, and I have found typically those “continuation shooting stars” tend to be reliable. However, we need to make a fresh, new low to confirm that move. In general, I suspect we are going to continue to see US dollar strength over the longer term.

AUD/USD Video 13.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement