Advertisement

Advertisement

AUD/USD Price forecast for the week of November 6, 2017, Technical Analysis

Updated: Nov 4, 2017, 06:11 GMT+00:00

The AUD/USD pair initially tried to rally during the week, but struggled just below the 0.7750 level and rolled over. By forming the shooting star at the

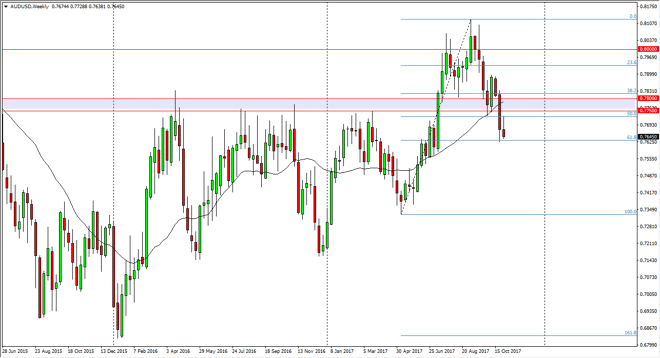

The AUD/USD pair initially tried to rally during the week, but struggled just below the 0.7750 level and rolled over. By forming the shooting star at the bottom of a downtrend on the weekly chart, it’s likely that we will continue to see sellers in this market. The 61.8% Fibonacci retracement level is just below the candle, and it looks likely that if we can break down below that level, the market should go much lower, perhaps reaching towards the 0.7350 level longer term.

On the weekly chart attached to this article, you can see that there is a purple rectangle that I look at as a major pivot point in this market. That was the resistance of an ascending triangle that got broken, but now we have pulled back through that level and that of course is a very negative sign. It is because of this that I don’t have any interest in buying this pair until we break above the 0.78 handle, or perhaps some type of supportive candle underneath. The 0.80 level above has offered enough resistance to turn the market around, which of course makes sense as it has been important going back decades. Right now, I believe that we are going to continue to see negative pressure, and gold markets are not going to help the situation either as they are starting to roll over.

With the Federal Reserve looking very likely to raise interest rates several times over the next year, it’s likely that this pair will favor the US dollar, at least until there are inflationary pressures in Australia, which currently we don’t see much of. It might be volatile, but I still believe that the sellers are going to come in and push to at least the 0.75 handle over the next couple of weeks.

AUD/USD Video 06.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement