Advertisement

Advertisement

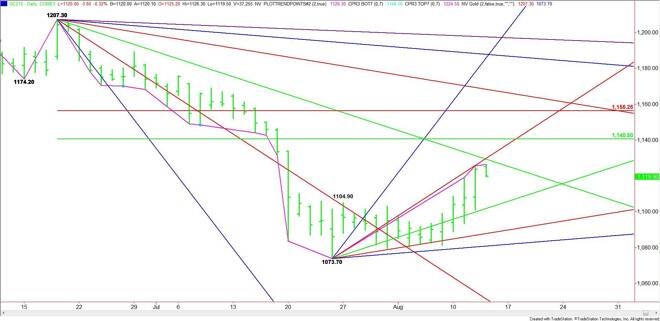

Comex Gold Futures (GC) Technical Analysis – August 13, 2015 Forecast

By:

December Comex Gold rallied slightly higher during the pre-market session, but a rebound by the U.S. Dollar encouraged some light profit-taking at

December Comex Gold rallied slightly higher during the pre-market session, but a rebound by the U.S. Dollar encouraged some light profit-taking at $1126.30.

The main trend is down on the daily swing chart, but this week’s acceleration to the upside indicates a slight shift in momentum to up.

The first upside target today is a potential resistance cluster formed by a downtrending angle at $1129.30 and an uptrending angle at $1129.70. This is the key area that bullish traders have to overcome today to sustain the move.

The main range is $1207.30 to $1073.70. Its retracement zone is $1140.50 to $1156.30. This is the primary upside target of this rally. Taking out the uptrending angle at $1129.70 could trigger enough upside momentum to at least test the 50% level at $1140.50.

A failure to reach the objectives today will indicate that the buying is over. This may be taking place during the pre-market session. Speculative buyers who went long earlier in the week have to be very careful with their positions because the daily chart indicates there is no support until $1101.70. This is today’s first downside target.

Today’s U.S. Retail Sales report at 8:30 a.m. ET could create a volatile reaction by the U.S. Dollar. If the report is bullish and the dollar rallies then look out below because gold could break $20.00. If the report is bearish and gold rallies then don’t expect too much of a move unless $1129.70 is taken out with conviction.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement