Advertisement

Advertisement

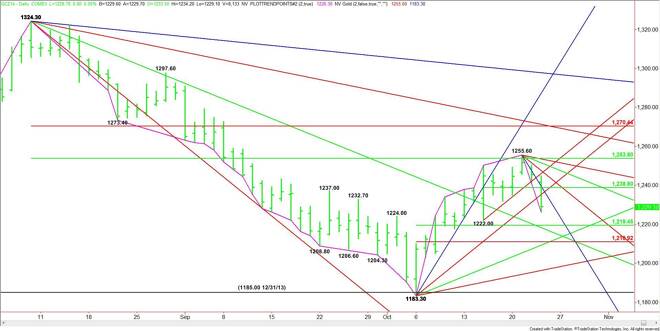

Comex Gold Futures (GC) Technical Analysis – October 24, 2014 Forecast

By:

December Comex Gold futures traded lower for a second day, making $1255.60 a new main top. The new main range is $1183.30 to $1255.60. The retracement

If the trend is getting ready to turn up then gold has to survive this break, or the market is likely to continue down to at least $1183.30. Holding a retracement into $1219.40 to $1211.00 could form a potentially bullish secondary higher bottom.

In addition to the retracement zone, potential support is an uptrending angle from the $1183.30 bottom at $1211.30. This angle forms a tight support cluster with the Fibonacci level at $1211.00, making it the best downside target today.

On the upside, the first resistance angle drops in at $1231.60. This is followed by a short-term pivot at $1238.80. Additional angles come in at $1243.60 and $1249.60.

The close near the low gives gold an early downside bias. Watch the order flow and price action on the first test of $1219.40. Aggressive counter-trend buyers may step in or short sellers may begin to take profits at this level, creating the potential for a technical bounce.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement