Advertisement

Advertisement

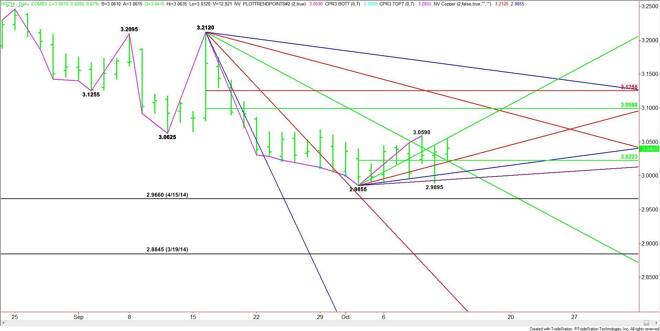

Comex High Grade Copper Futures (HG) Technical Analysis – October 14, 2014 Forecast

By:

December Comex High Grade Copper futures closed higher on Monday in limited price action. The close was high enough to put the market in a position to

The short-term range is 2.9855 to 3.0590. The mid-point of this range at 3.0225 is controlling the short-term direction of the market along with an uptrending angle at 3.0255. If this area fails then look for a break back into a pair of angles at 3.0055 and 2.9955.

The two angles are the last potential support levels before the low at 2.9895 and the main bottom at 2.9855. A failure at this price could drive the market into the April 15 bottom at 2.9660. The daily chart indicates there is plenty of room to the downside if 2.9660 fails. The next major downside target is the March 19 bottom at 2.8845.

If 3.0225 holds as support then look for a strong bias to the upside to develop. Crossing last week’s high at 3.0590 will indicate strength, but the market could accelerate to the upside if it can cross over to the bullish side of an uptrending angle at 3.0655.

Copper could begin to accelerate to the upside on a sustained move over 3.0655 since the daily chart indicates there is plenty of room until the next major upside target at 3.0990 to 3.1255. This retracement zone forms good resistance along with a downtrending angle at 3.1120.

Look for an upside bias to develop as long as 3.0225 holds as support, and a possible acceleration to the upside over 3.0655.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement