Advertisement

Advertisement

Commodity Prices Set For New Highs In June – What’s Next?

By:

Another day and another Commodity skyrockets to fresh record highs. That’s one of the most exciting trends of the Commodities Supercycle that we find ourselves in right now.

Commodities Fundamental Analysis

Traders are pumping more money into Commodities right now than at any time in the last decade, to capitalize on the four biggest and most explosive macro themes driving the Commodities Supercycle from Rapidly Surging Inflation, The Global Energy Shock, EV Revolution and Global Food Crisis.

One of the dominant themes of the current Commodity Supercycle that needs no introduction is the Global Energy Shock. This has captured the world’s attention and positioned the energy sector as one of the most sought after asset classes this year.

Last week, EU leaders announced an agreement to ban 90% of Russian Crude imports by the end of the year – adding a further supply shock to an already under-supplied market. Simultaneously, China – the world’s second-largest economy and biggest importer of Commodities – officially ended a two-month lockdown on June 1.

Both these pivotal events immediately sent Oil prices surging back $120 a barrel, the highest level since March. Expectations are now running high, that the Oil market may see an identical V-shape recovery in demand as seen in 2020 when China previously ended lockdown. That event triggered an historic bull run taking Oil prices from sub $40 a barrel in April 2020 to a decade high of almost $140 a barrel in April 2022. That’s a record-breaking gain of more than 450%, in the last two years.

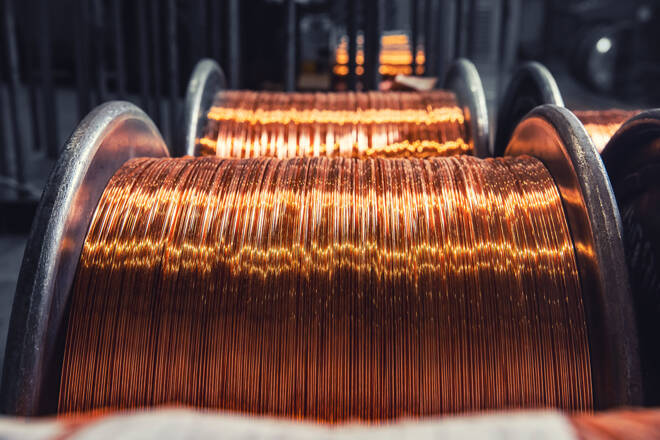

Elsewhere in the Commodity markets, another star performer last week was Copper.

Copper which is a key metal in infrastructure, electric vehicles and renewable energy surged on Wednesday after China launched a $120 billion credit line for mega Infrastructure and Green Energy projects to stimulate the economy.

The cliché move, straight out of an old policy playbook, echoes similarities with President Biden’s ambitious ‘Infrastructure spending frenzy and Green Energy Revolution’, almost exactly a year ago – which played a monumental role in kick-starting the current Commodities Supercycle.

Ultimately, China’s mega Infrastructure and Green Energy push means one thing. China is going to need more Commodities and lots of them.

Specifically industrial metals including: Aluminium, Copper, Cobalt, Nickel, Lithium, Palladium, Uranium, Zinc and Rare Earth metals, just to name a few.

But as we know, for the first time in decades, the world is running out of Commodities at a record pace and facing an historic shortage off the back of a “triple deficit” – low inventories, low spare capacity and low investment.

China’s growing appetite for Commodities is only going to exacerbate those issues and add further fuel to the Commodities Supercycle as global demand continues to outstrip supply.

To quote Warren Buffett, “the Commodity markets right now, represent one of the greatest generational opportunities of our lifetime, not to be missed.”

Commodity Prices Forecast Video for 6 – June 2022

Where are prices heading next? Watch The Commodity Report now, for my latest price forecasts and predictions:

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Phil Carrcontributor

Phil Carr is co-founder and the Head of Trading at The Gold & Silver Club, an international Commodities Trading, Research and Data-Intelligence firm.

Advertisement