Advertisement

Advertisement

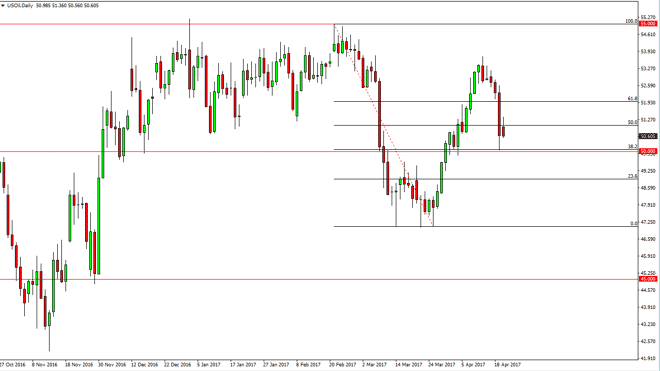

Crude Oil Forecast April 21, 2017, Technical Analysis

Updated: Apr 21, 2017, 03:59 GMT+00:00

WTI Crude Oil The WTI Crude Oil market initially tried to rebound during the Thursday session, but found enough resistance near the $51.50 level to turn

WTI Crude Oil

The WTI Crude Oil market initially tried to rebound during the Thursday session, but found enough resistance near the $51.50 level to turn around and form a negative candle. The $50 level underneath should be psychologically important, so I believe that a drop from here will face a significant amount of support. If we can break down below there, the market should then go towards the $49 level. The inventory number was as expected, but the biggest problem is the gasoline builds are gaining, meaning that demand is softening even more. Because of this, I believe that the oil markets are going to be very volatile over the next several sessions, but it certainly seems as if the sellers are trying to make some type of statement. You will have to be very nimble over the next several sessions to deal with this market. Alternately, if we break above the top of the candle for the session on Thursday, then the market would probably reach towards the $52.50 level above.

Crude Oil Forecast Video 21.4.17

Brent

Brent markets initially tried to rally as well but found the area above the $53 level to be too exhaustive and resistive to continue higher. It looks as if the market is ready to go even lower, perhaps reaching down to the $52 level, and then eventually the $50 level. This is a very bearish looking market, and because of this I think that both petroleum markets that we follow at FX Empire will find sellers. It appears that hedge funds are starting to change their attitude about OPEC production cuts, and with that being the case, we could continue to see sellers get involved every time this market rallies. However, if we break above the top of the candle during the Thursday session, the market probably tries to go to the $55 level above. Volatility is going to be very high in this market, and because of this you may be best served trading smaller positions in the CFD markets and avoiding the futures markets as this will keep your position size customizable.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement