Advertisement

Advertisement

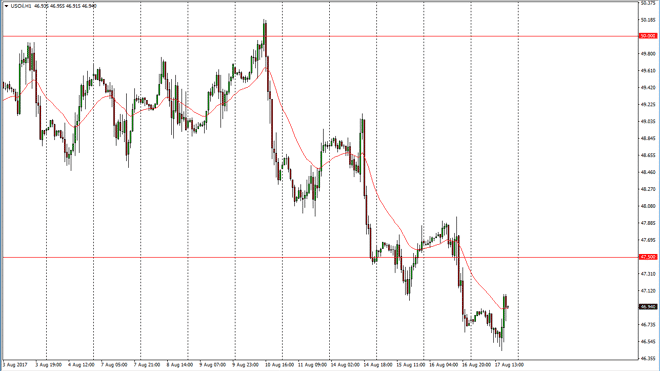

Crude Oil Forecast August 18, 2017, Technical Analysis

Updated: Aug 18, 2017, 05:32 GMT+00:00

WTI Crude Oil The WTI Crude Oil market initially fell during the day on Thursday, but found a bit of support at the $46.50 level. Nonetheless, I think

WTI Crude Oil

The WTI Crude Oil market initially fell during the day on Thursday, but found a bit of support at the $46.50 level. Nonetheless, I think that if we rally, we should find and I selling opportunity above. Of particular interest for me as the $47.50 level, and on the first signs of exhaustion in that area, I’m willing to sell. Keep in mind that we get the Baker Hughes Rig Count coming out today, and that of course can have a massive effect on this market as it shows how many drillers are active in America. If it comes out higher, that should cause quite a bit of resistance to rising prices in this market. I believe that some of the pop during the day has more to do with the US dollar than anything else. I believe that there is plenty of reason to think that eventually the sellers will come back.

Crude Oil Forecast Video 18.7.17

Brent

Brent markets initially fell as well, but found support at the psychologically important $50 level. We shot much higher during the day, but quite frankly I think it’s only a matter of time before the sellers return over here as well. That Rig Count of course is vital, and that should give us an idea as to where we go next. I think that a breakdown below the $50 level is catastrophic for this market though. I would be stunned to see this market break above the $52.50 level, so waiting to see some type of exhaustion to get involved. Ultimately, this is a market that I think will continue to be volatile, but there are plenty of reasons to think that we will continue to see massive selling over the longer term. I have no interest in buying currently.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement