Advertisement

Advertisement

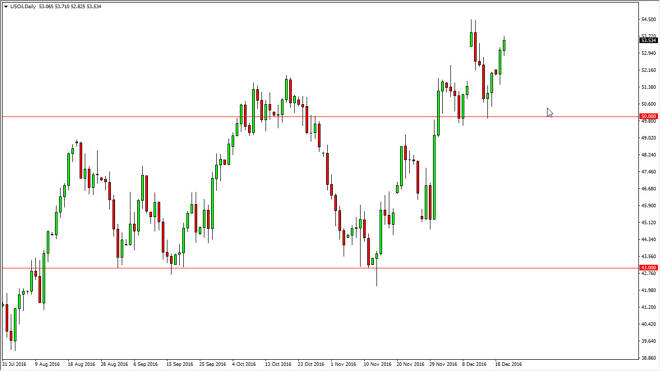

Crude Oil Forecast December 21, 2016, Technical Analysis

Updated: Dec 21, 2016, 08:43 GMT+00:00

WTI Crude Oil The WTI Crude Oil market rallied on Tuesday, as we are trying to reach towards the $54.50 level. A break above the $55 level would signify

WTI Crude Oil

The WTI Crude Oil market rallied on Tuesday, as we are trying to reach towards the $54.50 level. A break above the $55 level would signify that we are going much higher, as it is a continuation of the uptrend. A pullback from here could offer value the people will be taking again and again, but if we can break down below the $50 level, I believe that we will continue to go much lower. I think that given enough time we will continue to see volatility but it seems as if the market is favoring the upside at the moment. This is a market that has recently seen production cuts, but we have to see whether or not they are actually going to take hold. Also, you have to keep in mind that the shale producers in the United States and Canada will be very enticed to flood the market with supply as these higher values give us an opportunity to see sellers jump back into the marketplace. I think we go higher in the short-term, but over the longer term we will eventually see the market turn right back around. The $60 handle is a massive resistance barrier on longer-term charts.

Brent

The Brent Oil markets rallied on Tuesday, as we continue to see quite a bit of volatility. It now looks as if the market is going to reach towards the recent high at $57 or so, and with that being the case it’s likely that short-term pullbacks will offer buying opportunities. Even if we broke down from here, there is massive support at the $53 level so I believe it’s only matter of time before the buyers get involved again and again. A fresh new high of course is bullish, and the market should continue to reach towards the $60 level. Ultimately, there are quite a bit headline risk out there, due to the fact that the production cuts might be believable or perhaps even not. There is a lot of volatility coming as far as I can see, but quite frankly this is a weak that the market hesitates to move in drastic ways.

Related Articles

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement