Advertisement

Advertisement

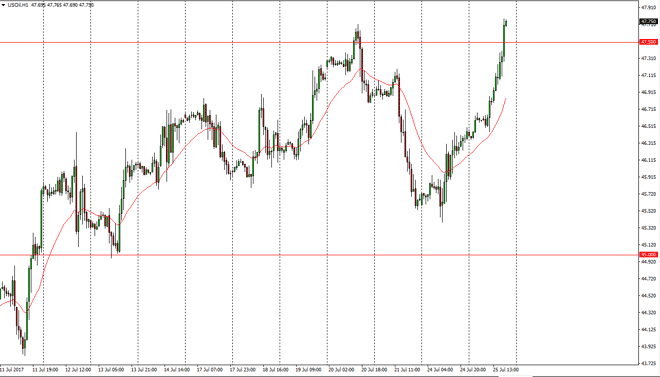

Crude Oil Forecast July 26, 2017, Technical Analysis

Updated: Jul 26, 2017, 04:41 GMT+00:00

WTI Crude Oil The WTI Crude Oil market broke out to the upside during the day on Tuesday, clearing the $47.50 level which of course is a resistance

WTI Crude Oil

The WTI Crude Oil market broke out to the upside during the day on Tuesday, clearing the $47.50 level which of course is a resistance barrier. Now that we have broken above there, the market should continue to go towards the $50 level above, and I think that short-term pullbacks continue to be buying opportunities. Given enough time, I think that we will probably have sellers reenter the market but with today’s FOMC Statement coming out and of course the Crude Oil Inventory announcement, there is so much in the way of noise today that it is probably difficult and maybe even dangerous to be involved in this market. It certainly looks as if the market does favor the upside in the short term though, so I suspect that if you had to be involved in this market it’s probably best to be long than anything else.

Oil Forecast Video 26.7.17

Brent

As I write this, Brent markets have not broken out, and are facing a significant amount of resistance. However, if the WTI market continues to go higher, the brand market will follow. I suspect that the US dollar will dictate what happens next, and that is still a huge question at this point. Because of this, waiting till the end of the day for clarity might be the safest way to trade this market, or at the very least I would be trading small positions so that your losses don’t accumulate rapidly and what will certainly be a very noisy trading scenario. It is possible that we will see the beginning of longer-term moves at the end of the session, so tomorrow’s analysis will be crucial as to where we go next, and I have course will have that for you here at FX Empire.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement