Advertisement

Advertisement

Crude Oil Forecast March 23, 2017, Technical Analysis

Updated: Mar 23, 2017, 05:53 GMT+00:00

WTI Crude Oil The WTI Crude Oil market initially fell during the session on Wednesday, but found support yet again near the $47 level. By doing so, it

WTI Crude Oil

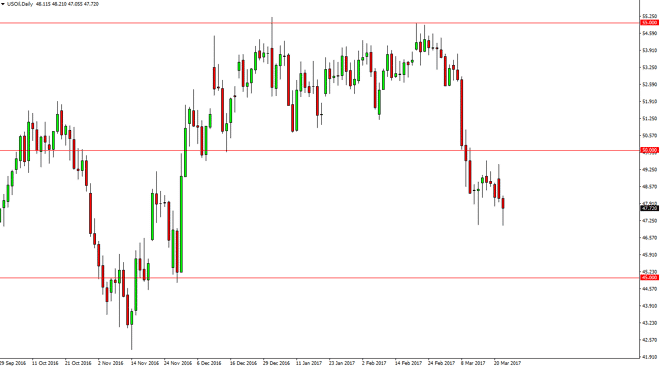

The WTI Crude Oil market initially fell during the session on Wednesday, but found support yet again near the $47 level. By doing so, it suggests that the market may be comfortable with 5 million barrels build announced during the session on Wednesday, because quite frankly it wasn’t as bad as it could have been. A break below the bottom of the candle for the session should send this market towards the $45 level underneath. Rallies are still selling opportunities above, reaching towards the $50 handle. That is a large, round, psychologically significant number, which previously had been supportive. And exhaustive candle near that area would be an opportunity to start selling yet again. We have seen a massive selloff, and I believe that the uptrend is completely broken now. The $45 handle will of course be the next massive battle.

Crude Oil Price Forecast Video 23.3.17

Brent

Brent markets tried to follow during the day on Wednesday as well, slicing below the $50 level but there were enough buyers underneath to support the market slightly. I believe a short-term rally could be coming, but given enough time and I believe you will get the opportunity to start selling a higher level. Certainly the $53 level above has been massively resistive recently, and I think given enough time the sellers will come back into this market. Alternately, we could break down below the bottom of the hammer and that is a selling opportunity as well. Either way, I think given enough time we reach towards the $45 level in this market as well.

A market that has broken down the way this one has, normally offers more momentum to the downside and the oversupply will continue to work against the value of crude oil. After all, the announcement of an additional 5 million barrels of supply shows just how oversupply this market is. We continue to see the market on wind the massively bullish trades that we had seen after the OPEC production cuts were announced. Quite frankly, the United States, Mexico, and certainly Canada don’t care about OPEC production cuts, and will continue to supply the market.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement