Advertisement

Advertisement

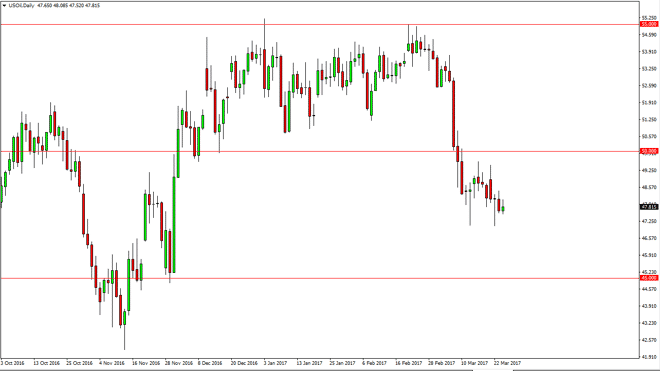

Crude Oil Forecast March 27, 2017, Technical Analysis

Updated: Mar 25, 2017, 05:35 GMT+00:00

WTI Crude Oil The WTI Crude Oil market initially tried to rally during the session on Friday, but found enough resistance to turn around and form a little

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the session on Friday, but found enough resistance to turn around and form a little bit of a shooting star. The shooting star of course is a sign of exhaustion but I see significant support near the $47 level. A breakdown below there, then I believe the market sends its prices down to the $45 handle. Any rally at this point in time will have to deal with quite a bit of resistance near the $50 handle, which is a massive psychological number, and previous support. Because of this, I look at rallies as potential selling opportunities in a market that has clearly broken down recently. $45 below should be massively supportive, but if we break down below there I think that the market will continue to go much lower.

Crude Oil Inventories Video 23.3.17

Brent

Brent markets went back and forth during the day on Friday, as the $50 level has offered a bit of support. If we can break down below there, the market should then go much lower, perhaps reaching down to the $45 handle. If we rally from here, I think that the $53 level above is massively resistive. An exhaustive candle would be a selling opportunity, but if we managed to break above there means that we would more than likely reach towards the $55 handle.

I believe that the downward move that we have seen recently has been very strong, and that suggests to me that the overall attitude of the markets have changed. The oversupply should continue to be very negative, and thus I have no interest in buying. I believe that the markets will continue to punish oil due to the inability of OPEC to control supply anymore. There is far too much in the way of supply coming out of the United States, Canada, Mexico, and several other countries to give OPEC any serious weight when it comes to the markets themselves. The days of OPEC controlling prices for oil are long gone at this point.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement