Advertisement

Advertisement

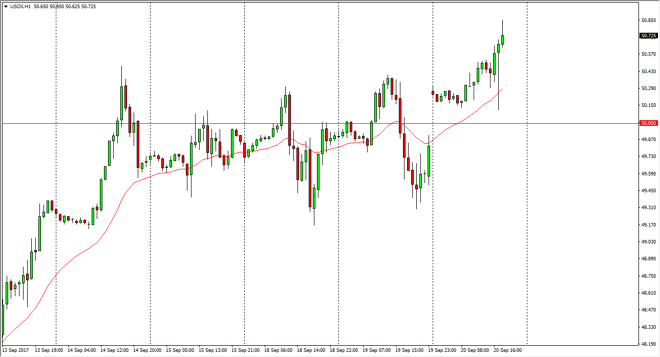

Crude Oil Forecast September 21, 2017, Technical Analysis

Updated: Sep 21, 2017, 06:03 GMT+00:00

WTI Crude Oil The WTI Crude Oil market gapped higher at the open on Wednesday, clearing the $50 handle with no issues whatsoever. We pull back to test

WTI Crude Oil

The WTI Crude Oil market gapped higher at the open on Wednesday, clearing the $50 handle with no issues whatsoever. We pull back to test that level, and we have seen some buying pressure since then. We are now looking at the $51 level, and a break above there would be a very bullish sign, perhaps sending this market as high as $55 after that. Currently, looks as if the buyers are having the way, and it seems as if we are starting to drift into a higher range. If we were to break down below the $49 level, that could be kind of ugly, but in the short term it looks as if the buyers are certainly going to have their way. I believe dips are probably can offer short-term buying opportunities in what will be very choppy marketplace. Keep in mind though, as oil prices go up, the Americans will drill for more.

Crude Oil Price Forecast Video 21.9.17

Brent

Brent markets exploded right away to the upside on Wednesday, breaking above the vital $56 level. I think that pullbacks at this point are going to be nice buying opportunities as the market looks likely to go looking towards the $60 level next. The volatility will continue, as it always does and the oil markets, but I think that there is more than enough support below and extending down to the $55 level to make buying the most obvious trade. If we were to break down below the $55 level, that would be a very negative sign, but currently I don’t think that’s going to happen. I think we are much more likely to test the $57.50 level in the short term then pull back like that. Currently, I believe that Brent will outperform WTI.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement