Advertisement

Advertisement

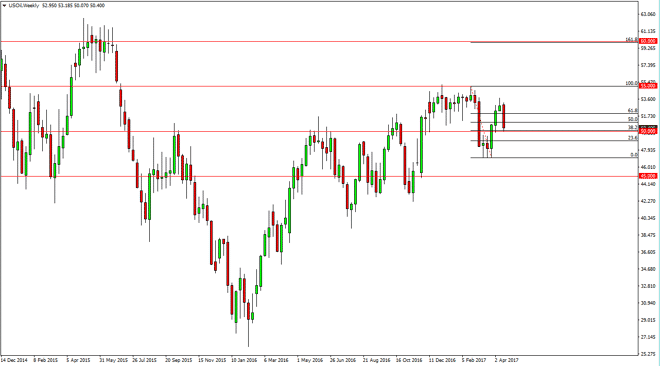

Crude Oil forecast for the week of April 24, 2017, Technical Analysis

Updated: Apr 22, 2017, 04:29 GMT+00:00

WTI Crude Oil The WTI Crude Oil market broke down during the week, clearing the bottom of the shooting star from the previous week. We did find some

WTI Crude Oil

The WTI Crude Oil market broke down during the week, clearing the bottom of the shooting star from the previous week. We did find some support near the $50 level though, so it could continue to be choppy. A breakdown below there should send this market reaching towards the $46.50 level underneath, and perhaps $45 after that. Ultimately, I believe that we are starting to see some very bearish fundamentals in the crude oil market, so I believe that the sellers are starting to come back into the market with full force. However, if you’re going to trade this market from a longer-term standpoint, you’re going to have to deal with a significant amount of volatility. Because of this, it’s probably better to trade this market off shorter-term time frames.

WTI Video 24.4.17

Brent

Brent markets broke down below the $55 level during the week, clearing the bottom of the shooting star. Not only that, we broke down below the previous consolidation area as we are now below the $53 level. A breakdown below the bottom of the candle for the week should send this market looking for the $50 level over the next several sessions. Brent builds are starting to get very large, and because of that it shows that there is a serious lack of demand. If we break down below the $50 level, I feel that the market should continue to go much lower. The markets are very volatile at the moment, but I believe that the shorter time frames you probably can be easier to trade in this market as well. There are a lot of moving pieces when it comes to the oil markets, so having said that it’s likely that it will be easier to trade from the 4-hour chart. I believe that we are starting to see serious negativity in the marketplace as hedge funds are starting to pull some of their positions away from the futures markets. Because of this, I believe that the bearish pressure should continue, at least in the short run.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement