Advertisement

Advertisement

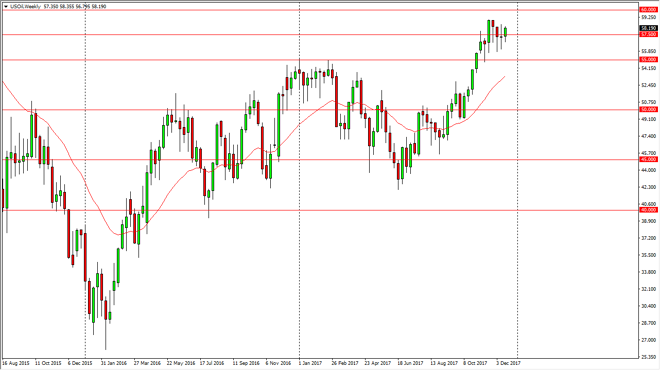

Crude Oil forecast for the week of December 25, 2017, Technical Analysis

Updated: Dec 23, 2017, 06:57 GMT+00:00

Without a doubt, the biggest issue this week is going to be a lack of liquidity and volume. However, I think that the charts are trying to show us where we are going over the next several weeks.

WTI Crude Oil

The WTI Crude Oil market had a slightly positive week, breaking above the $57.50 level. I think that we are going to go looking towards the $60 handle next, but that could be a bit psychologically resistive, causing a bit of a push back. However, if we were to break above that level, I think the market then goes to the $62.50 level next. Alternately, if we break down below the $55 level, oil will probably drop down to the $50 handle. I think the $50 handle is of course psychologically important, so it’s very likely that it will attract a lot of attention.

Crude Oil Inventories Video 25.12.17

Brent

Brent markets rose during the week, slamming into the $65 level and closing at the highs. While this level offered a significant amount of resistance during the previous week, and push the market down to form a shooting star, this week ended up looking very bullish and it looks likely that we are going to try to break above the top of the shooting star, and go looking towards the $67.50 handle. Alternately, we could pull back from here, but I think it’s not until we break down below the $60 level that it will be easy to sell this market. The market has rallied significantly, and I think that a lot of the concerns about oversupply may come back into the market, so I think that even if we do rally, taking profits relatively soon would probably be the best way to trade this market. I expect more volatility going forward, not less.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement