Advertisement

Advertisement

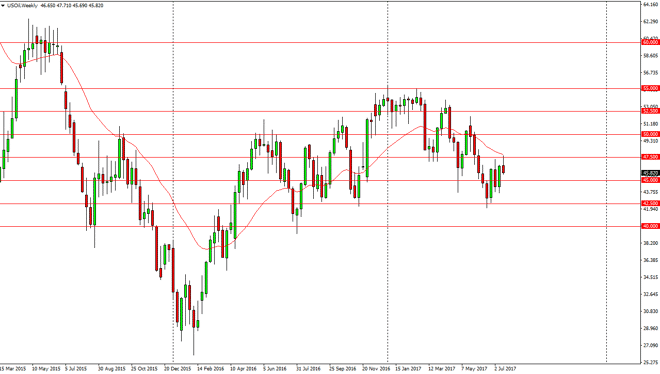

Crude oil forecast for the week of July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:43 GMT+00:00

WTI Crude Oil The WTI Crude Oil market initially tried to rally during the week, but found enough resistance near the $47.50 level to turn around and form

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the week, but found enough resistance near the $47.50 level to turn around and form a shooting star. The shooting star is a negative sign, and I believe that we are going to fall from here. In fact, I believe that we will first approach the $45 level, but then breakdown below there and reach towards the $42.50 level after that. I believe that the market is going to continue to find bearish pressure longer-term, and then it’s all but impossible to buy this market from a longer-term perspective. After all, the oversupply of crude oil is a well-known fact, and OPEC has lost the ability to control the market. I believe that although the US dollar is falling, crude oil markets will continue to do so as well.

WTI Video 24.7.17

Brent

Brent markets also rally during the week, but found the $50 level to be resistive enough to turn around and form a shooting star. The market looks very likely to drift to the $47.50 level, and then eventually break out to the $45 level after that where I would expect to see a significant amount of support. Ultimately, if we break above the $50 level, that would be a very bullish sign but right now it looks as if we are trying to roll over in a market that has been bearish for some time. Oversupply continues to be a massive issue, and the brick market will fare any different than the WTI Crude Oil market, as traders continue to look at an overall bearish picture longer-term. I think that once we break the $45 level, the market will probably go looking for the $42.50 level.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement