Advertisement

Advertisement

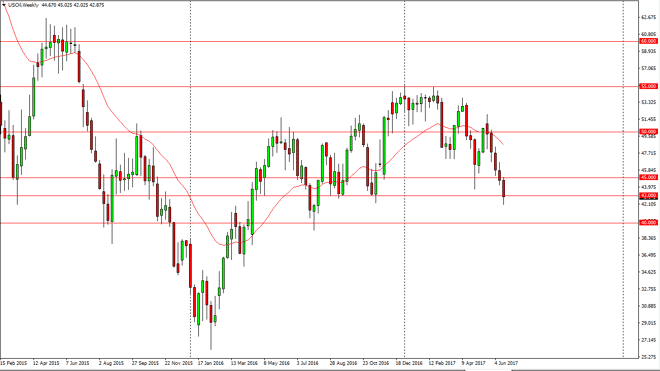

Crude Oil forecast for the week of June 26, 2017, Technical Analysis

Updated: Jun 24, 2017, 05:15 GMT+00:00

WTI Crude Oil The WTI Crude Oil market broke down during the week, slicing through the $45 level and even breaking down below the $43 level. Now that we

WTI Crude Oil

The WTI Crude Oil market broke down during the week, slicing through the $45 level and even breaking down below the $43 level. Now that we have done that, the market turned around to show signs of life at the $42 level. Ultimately though, I think we do breakdown below the bottom of the candle and send this market looking for the $40 handle. The $45 level above should offer resistance, so I think even if we do bounce from here, we should then find sellers. Given enough time, the market looks ready to sell all, so I don’t have any interest in buying. If we were to somehow breakdown below the $40 level, then we could do fall apart rather drastically. There’s far too much supply out there to have this market rally for any real significance.

WTI Video 26.6.17

Brent

Brent markets fell during the week as well, slicing through the $45 level. By doing so, the markets found a little bit of support, but I think there is still plenty of bearish pressure out there. If the market breakdown below the bottom of the range, the market probably goes down to the $42 level. We have recently broken uptrend line, and quite frankly I don’t see the reason to think that this market is going to suddenly rally. I believe that we were more than likely going to find sellers every time we try to bounce, and with this being the case I think that the market then goes down to the $40 handle.

I also believe that there is a massive ceiling in this market near the $50 handle, so exhaustive candle’s will be sold, just as a breakdown below the candle would be. Given enough time, I think Brent continues to suffer just like WTI well.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement