Advertisement

Advertisement

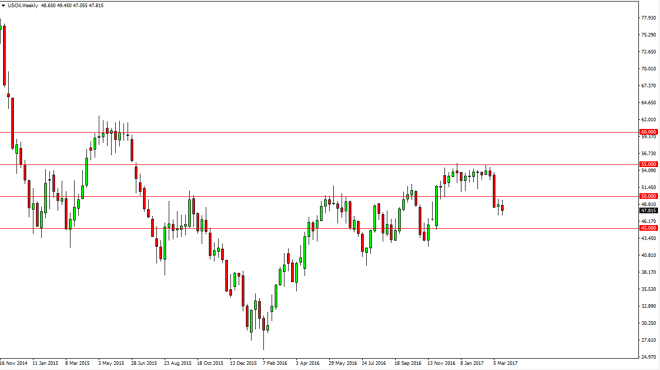

Crude Oil forecast for the week of March 27, 2017, Technical Analysis

Updated: Mar 25, 2017, 05:37 GMT+00:00

WTI Crude Oil The WTI Crude Oil market fell during the week, but have quite a bit of volatility. It looks as if the $50 level above will continue to be

WTI Crude Oil

The WTI Crude Oil market fell during the week, but have quite a bit of volatility. It looks as if the $50 level above will continue to be resistive, so if we can break above there it would be a very bullish sign. However, I think the market will not get above the $55 level, and I believe that rallies will be selling opportunities. Longer-term, I anticipate that this market is going to reach towards the $44 level, and possibly even lower than that. Currently, OPEC has production cuts in play, but quite frankly the rest of the world is not paying attention, and the oversupply continues. I can make an argument for an uptrend line just below, that’s why I believe that a breakdown below the $45 level is so catastrophic. If we somehow broke above the $55 level, that would be very bullish but I highly doubt it’s going to happen.

Crude Oil Inventories Video 23.3.17

Brent

Brent markets fell during the week, reaching towards the $50 handle. That’s an area where you would expect to see quite a bit of psychological support and of course interest in general. Because of this, I think that a breakdown below the bottom of the candle would be very negative, and should send this market down to the $45 handle. A breakdown below there is catastrophic, as the market would continue to see pressure down to the 30s. I think rallies at this point in time will be selling opportunities, and it’s only a matter of time before and exhaustive candle would return, especially if we get close to the $55 handle.

Brent markets are oversupplied, just as the WTI markets are, so I don’t see any reason for this market to diverge from its cousin. In fact, a rally at this point will more than likely just offer a better opportunity to short this market. I believe that even if we rally significantly from here, $60 is still the absolute ceiling in the market longer term. Expect volatility, but I still believe that the bearish pressure will overtake.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement