Advertisement

Advertisement

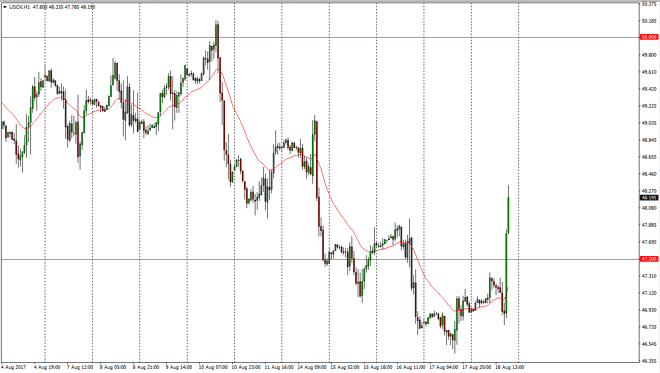

Crude Oil Price Forecast August 21, 2017, Technical Analysis

Updated: Aug 19, 2017, 05:00 GMT+00:00

WTI Crude Oil Crude oil inventories have tightened in the United States, which this is essentially what people were waiting on in the oil pets. Because of

WTI Crude Oil

Crude oil inventories have tightened in the United States, which this is essentially what people were waiting on in the oil pets. Because of this, the markets have broken out to the upside and look ready to go higher. I still think there’s a hard ceiling somewhere closer to the $50 level, but certainly the short term momentum is to the upside. Pullbacks should find plenty of support, especially near the $47.50 level. Longer-term, I think there are going to be some issues, but I believe that short-term buyers will get with a one, and then eventually the sellers will get what they want closer to the $50 handle.

Crude Oil Inventories Video 21.8.17

Brent

Brent markets are currently testing the $52.50 level, and this is an area that being broken above could send this market looking towards the $53.50 level. I expect to see pullbacks, and eventually sellers come back in but right now it certainly looks as if the buyers are going to be heavily involved in this market, perhaps with a bit of a “buy on the dips” type of mentality. Selling is all but impossible and the short-term, as it is obvious that the oil markets have gotten a turbo boost during Friday’s session.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement