Advertisement

Advertisement

Crude Oil Price Forecast August 9, 2017, Technical Analysis

Updated: Oct 7, 2017, 06:27 GMT+00:00

WTI Crude Oil The WTI market collapsed during the session on Friday, breaking towards the $49 level. If you been following my analysis, you know that I

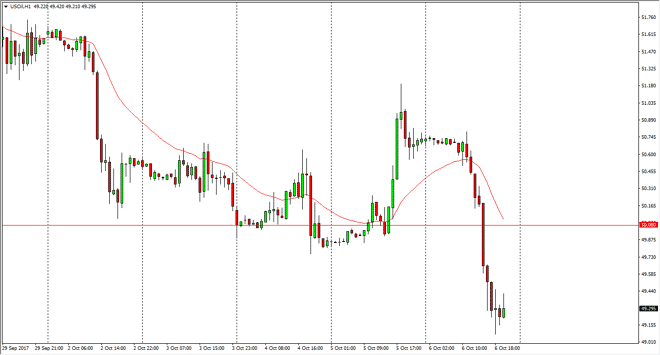

WTI Crude Oil

The WTI market collapsed during the session on Friday, breaking towards the $49 level. If you been following my analysis, you know that I recognize $49 as a major support level. If we can break down below there, then I think it’s time to start selling aggressively as it should send this market towards the $46 level. If we rally from here, I think we are still going to see a lot of noise at the $50 handle, so keep that in mind. Ultimately, this is a market that continues to suffer from oversupply, and quite frankly I don’t think that rallies can sustain themselves for very long. That being said, there’s also support underneath, so I think we will continue to see the volatile choppiness going forward. Paying attention to the $49 level tells me what to do next.

Crude Oil Inventories Video 09.10.17

Brent

Brent markets also collapsed, reaching towards the $55 level, which for me is much like the $49 level in the WTI Crude Oil market. If we can break down below the $55 level, the market should continue down to the $52.50 level after that. Brent markets continue to look very vulnerable, and I think that rallies could be selling opportunities. This will be especially true if we break down below the $55 level, as I think that the selling pressure will accelerate. Ultimately, I think that the markets will remain volatile, and I do like selling rallies as they appear. However, I would keep my position size small as there is a lot of noise out there, and of course let headlines that could move the markets. OPEC has lost its pricing power, and I think the markets are just now starting to come to terms with this longer term.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement