Advertisement

Advertisement

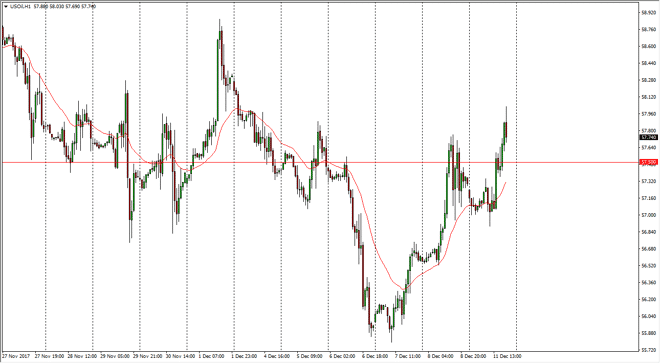

Crude Oil Price Forecast December 12, 2017, Technical Analysis

Updated: Dec 12, 2017, 06:06 GMT+00:00

Crude oil markets continue to be very volatile, as we are trying to break out above significant resistance and continue the bullish pressure that we had seen previously.

WTI Crude Oil

The WTI Crude Oil market was quite initially during the trading session on Monday, but then broke above the important $57.50 level to show signs of strength, and I think that short-term pullbacks will probably offer short-term buying opportunities, perhaps reaching towards the $58.50 level above. Alternately, if we break down below the $57 level, the market should then send price down to the $56 level at that point. Crude oil markets continue to be very volatile, because while we have OPEC extending production cuts through 2018, we also have concerns about demand and of course the influence on the market by the US dollar, as when it rises, that typically works against the value of oil. With this, I think short-term buying opportunities present themselves, but be quick to take profits.

Crude Oil Video 12.12.17

Brent

Brent markets gapped lower initially during the trading session on Monday, but then broke out to the upside, breaking well above the $64 level. That’s a very good sign, and currently looks as if we are trying to pull back to build up momentum, which I would expect to see at the $64 handle. The $65 level above is significant resistance though, so I think that if we break above there would be a very strong sign indeed. The latest moved has been very beneficial for the buyers, but we are still not clear of the significant noise above. Because of this, I think that short-term pullbacks are buying opportunities, but I also recognize that if we were to break down below the $63 level, then the sellers would overwhelm the market.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement