Advertisement

Advertisement

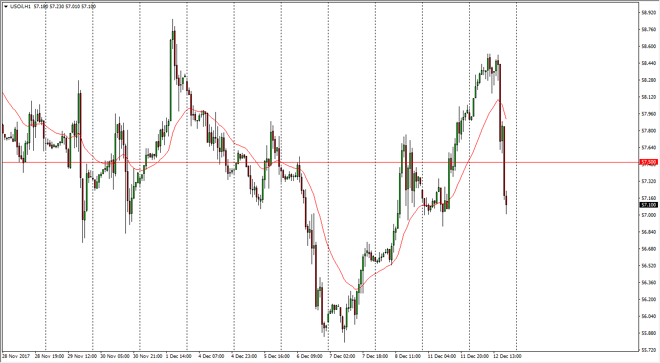

Crude Oil Price Forecast December 13, 2017, Technical Analysis

Updated: Dec 13, 2017, 06:13 GMT+00:00

The crude oil markets initially tried to rally, but then broke down significantly below support. This is a market that continues to be very noisy, but this return to lower levels suggests that we are in fact going to continue to struggle.

WTI Crude Oil

The WTI Crude Oil market rallied slightly during the trading session on Tuesday, but rolled over rather drastically, slicing through the $57.50 level. Because of this, it’s a very negative looking move, but I think that the $57 level is offering a certain amount of bullish pressure that could cause a bit of a bounce. I think that the longer-term outlook for oil is starting to roll over, as hedge funds have been taking profits over the last couple of sessions. Market participants will have to deal with the lot of noise in this market, but eventually we will settle into some type of range.

Oil Forecast Video 13.12.17

Brent

Brent markets also fell over after initially trying to rally, finding the $65 level a bit too expensive. By doing so, we have broken below the $64 handle, finding support at the $63.50 level. I think we could bounce from here, but if we were to break down below the $63 handle, at that point the sellers would get aggressive, as it would essentially form a “two-day shooting star.” I think volatility is here to stay, so pay attention, I look at this market as a binary opportunity, a move above $64 tells us to serve buying, move below the $63 handle tells us to start selling. In the meantime, it’s a lot of choppiness that essentially isn’t ready to put certainty into the marketplace. Because of this, be patient and allow the market to tell you which direction to get involved in.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement