Advertisement

Advertisement

Crude Oil Price Forecast December 29, 2017, Technical Analysis

Updated: Dec 29, 2017, 04:55 GMT+00:00

Oil markets have been very noisy over the last 24 hours, as we continue to see a certain amount of thin trading between holidays.

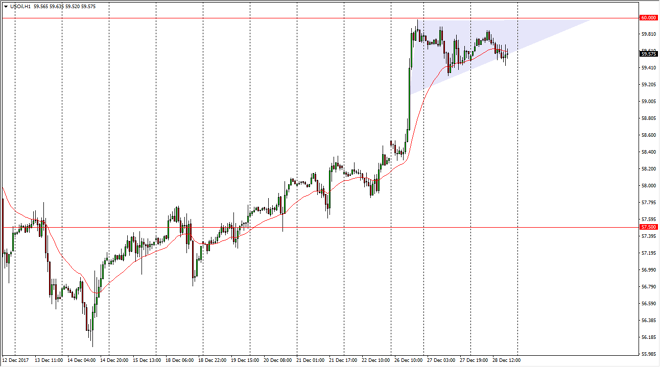

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the trading session on Thursday, but then drifted towards the $59.50 level. I think there is a significant amount of resistance at the $60 level above, which of course is a massive barrier as the market continues to look at large, round, psychologically significant numbers for guidance. We don’t have much in the way of volume currently, as we are between the 2 biggest holidays of the year. I believe that if we break above the $60 level, the market will then go to the 6205 zero dollars level above. If we break down below the $59 level, I think the market will go looking towards the $58.50 level. Ultimately, this is a market that continues to be very noisy, but at this point I think there is potential for disruption.

Crude Oil Forecast Video 29.12.17

Brent

Brent markets fell during the trading session during Thursday, as we gapped lower, rallied to fill the gap, then turned around to fall yet again. It looks like we are going to go looking towards the uptrend line, which of course is what has lifted the market since the middle of December. I believe that given enough time, we may have to make a serious decision at the uptrend line, and if we do the market probably goes down to the $65 handle. That is an area that is massively supportive, but a breakdown below there is very negative, and should send this market much lower. I would become aggressive at that point, but in the meantime it’s likely that we will simply slam around.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement