Advertisement

Advertisement

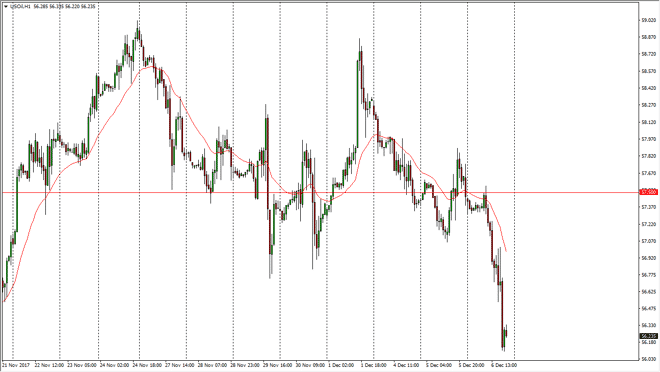

Crude Oil Price Forecast December 7, 2017, Technical Analysis

Updated: Dec 7, 2017, 06:02 GMT+00:00

WTI Crude Oil market fell rather drastically during the session, dragging Brent with it. Crude oil markets continue to struggle as oversupply continues to be a major issue.

WTI Crude Oil

The WTI Crude Oil market initially went sideways, but found the $57.50 level to be enough resistance to roll over and as the inventory number was much more bearish than anticipated, the markets fell apart. It looks likely that rallies at this point should find sellers, and I would be very interested in selling oil near the $56.90 level if we get enough of a bounce. Alternately, if we were to break above the $57.50 level again, that would be an extraordinarily bullish sign. I believe that the $55 level will be targeted over the longer term, so now it’s just a question as to how we go down to that level.

Crude Oil Price Forecast Video 07.12.17

Brent

Brent markets did the same thing as well, initially tried to rally but found enough resistance near the $63 level to break down significantly and reach towards the $61.50 level. I believe that short-term rallies are nice selling opportunities, so therefore I will use them as such on exhaustive candle’s. The $60 level underneath is the target, as it has been important more than once. With the oversupply of oil and lack of demand, it looks as if the higher pricing of crude oil lately has brought in far too much in the way of US oil.

I have no interest in buying unless of course we can break above the $64.50 level which would show a complete turn around and signs of life in this market. I suspect that isn’t going to happen in the short term though, so right now I remain of the bearish mindset.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement