Advertisement

Advertisement

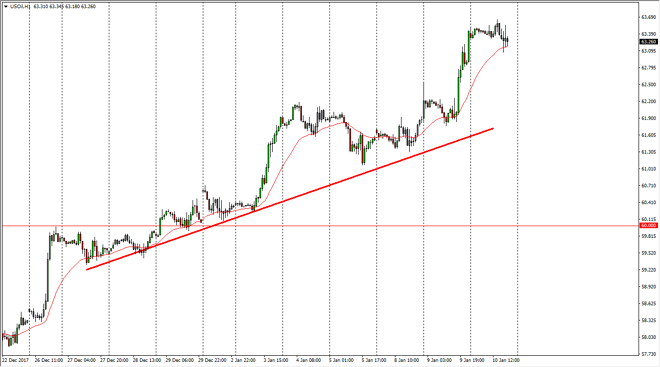

Crude Oil Price Forecast January 11, 2018, Technical Analysis

Updated: Jan 11, 2018, 05:15 GMT+00:00

The crude oil markets were somewhat quiet during the trading session on Wednesday, but remain elevated and look as if there is plenty of momentum to be found in these markets.

WTI Crude Oil

The WTI Crude Oil market looks likely to continue to go sideways, perhaps with a slight negative bias, as we have gotten a little bit overextended on the short-term charts. Regardless, I believe that the markets will be looking to rally on dips, as value hunters will reappear and of course day traders will be interested in taking advantage of the volatility. I believe that the markets continue to be a situation where it becomes “buy on the dips”, as there are a lot of factors working in favor of the oil markets currently, including production cuts coming out of both Russia and OPEC countries, but at the same time the US dollar has been getting beaten up a little bit of the last couple of weeks, and that has provided a little bit of bullish pressure as well.

Crude Oil Price Forecast Video 11.01.18

Brent

Brent markets also got a boost during the last couple of sessions, as the inventory numbers came out rather bullish coming from America. I believe that the uptrend line underneath will continue to hold this market higher, so on pullbacks I would anticipate seeing plenty of buyers interested in the $68 region. I anticipate a move to the $70 level over the longer term, and look at these pullbacks as potential opportunities for short-term traders to get involved in a market that has been so overly bullish. If we were to break down below the $67.50 level, we could find ourselves looking towards the $65 level longer term. At this point though, I think that the buyers will continue to run the show.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement