Advertisement

Advertisement

Crude Oil Price Forecast January 12, 2018, Technical Analysis

Updated: Jan 12, 2018, 04:58 GMT+00:00

Crude oil markets were bullish during the trading session on Thursday, as we continue to see buyers jump into the petroleum markets in general. Pullbacks continue to offer buying opportunities, and it now seems as if we are heading to very specific levels.

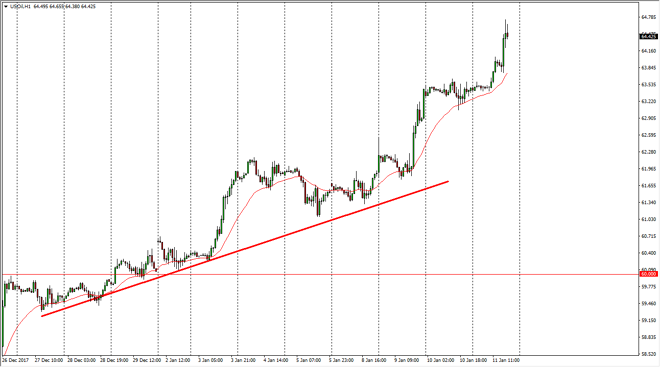

WTI Crude Oil

The WTI Crude Oil market continues to rally, but later in the day on Thursday looks likely that we will pull back a bit. I believe that the market will probably find plenty of buyers underneath, near the $63.50 level. That’s an area that I think could cause a significant amount of support though, as it was significant resistance. I believe that the market will continue to find reasons to go higher, at least in the short term. The $65 level above is a large, round, psychologically significant number, and an area that I think buyers are going to be looking towards. We have been in an uptrend for a while, and I suspect that’s going to be the way going forward although there are some potential storm clouds on the horizon.

Crude Oil Forecast Video 12.01.18

Brent

Brent markets went sideways initially, rallied a bit during the day on Thursday, pulled back to test the open price again, and then rallied again. Later in the day though, we are starting to shy away from the $70 handle, so we may see another pullback. If we can break above the $70 level, I think the market then goes looking towards the $72.50 level after that. The uptrend line underneath continues to offer support, and a falling US dollar of course offers support for commodities in general, and of course Brent isn’t going to be any different. Ultimately, I suspect that the trend line underneath holds as support, offering a “buy on the dips” opportunity.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement