Advertisement

Advertisement

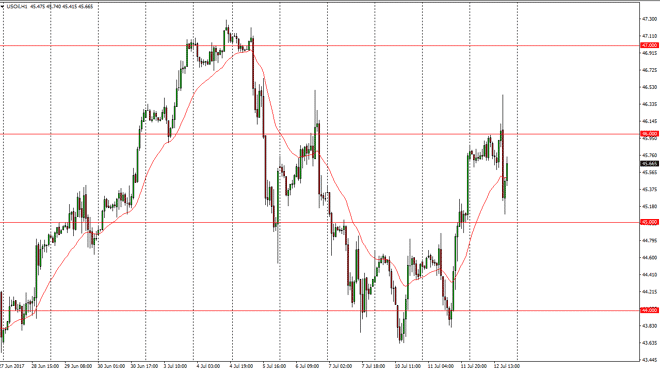

Crude Oil Price Forecast July 13, 2017, Technical Analysis

Updated: Jul 13, 2017, 06:57 GMT+00:00

WTI Crude Oil The WTI Crude Oil market fell significantly during the session after the inventory number was very bearish. However, we found enough support

WTI Crude Oil

The WTI Crude Oil market fell significantly during the session after the inventory number was very bearish. However, we found enough support at the $45 level to turn things around and it now looks as if we are trying to normalize somewhere just below the $46 level. Because of this, I think there is a bit of bullish pressure short-term, but longer-term I am still very negative for this market. I think the market will probably try to reach towards the $47 level over the next several sessions, but either way is can be very difficult to trade this market as it is very choppy and quite frankly the fundamentals aren’t necessarily bullish. One of the biggest reasons for oil rallying could be the fact that the USD/CAD pair fell rather significantly.

Crude Oil Price Forecast Video 13.7.17

Brent

Brent markets went sideways initially during the day on Wednesday, and then broke down below the $48 level after an initial attempt to go higher. It looks as if we are getting a little bit of support in the crude oil market, and I believe that short-term we will see buying on dips. However, I would be very surprised to see this market ever break above the $50 level. Some type of exhaustive candle above on the daily timeframe will probably be what I’m looking for to sell, and I do think the longer-term we continue to fall. However, and the short-term it looks like the buyers are starting to make a case, or at least one could suggest that perhaps the short covering rally continues. You the way, I’m very sure of the negativity in this market longer term, but in the meantime, I think that we will get a lot of counter trend moves.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement