Advertisement

Advertisement

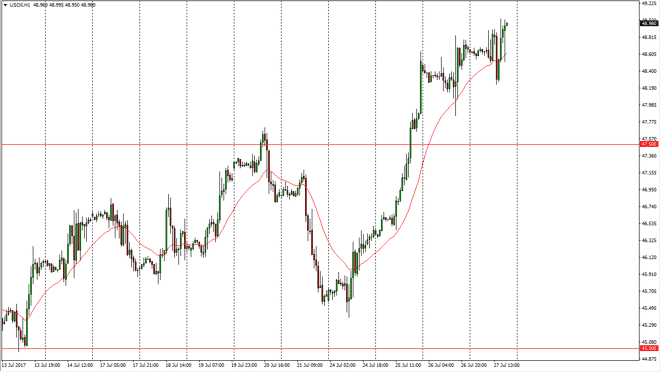

Crude Oil Price Forecast July 28, 2017, Technical Analysis

Updated: Jul 28, 2017, 04:58 GMT+00:00

WTI Crude Oil The WTI Crude Oil market initially went sideways during the session on Thursday, and then dipped. However, somewhere near the $48.25 level,

WTI Crude Oil

The WTI Crude Oil market initially went sideways during the session on Thursday, and then dipped. However, somewhere near the $48.25 level, the trader started to jump back into the market and push it higher. We broke above the $49 handle, showing signs of strength yet again. I believe that we are going to make a run towards the $50 level, where I would expect to see a significant amount of resistance. Because of this, the market should continue to see a lot of volatility in that general vicinity, but in the short term I think that the buyers are going to continue to run the show. I believe that there is significant support at $47.50 below though, so I anticipate that we get a bit of a “2 speed market.”

Crude Oil Forecast Video 28.7.17

Brent

Brent markets have outperformed the WTI market slightly during the day on Thursday, but I think that given enough time we should see buyers get involved as we continue to push towards the $52.50 level. The $50 level below will be an obvious support level, and I think that when the market rolls over again, and I do think that it will, that will be the target. There are plenty of reasons to think that the oversupply continues, so with this being the case it’s likely that the bearish pressure will eventually reassert itself. Some of this is due to the weaker US dollar, which quite frankly isn’t reason enough to drive the rally for the longer term. Given enough time, both the bears and bulls will continue to get what they want, as there are should continue to be massive volatility overall.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement