Advertisement

Advertisement

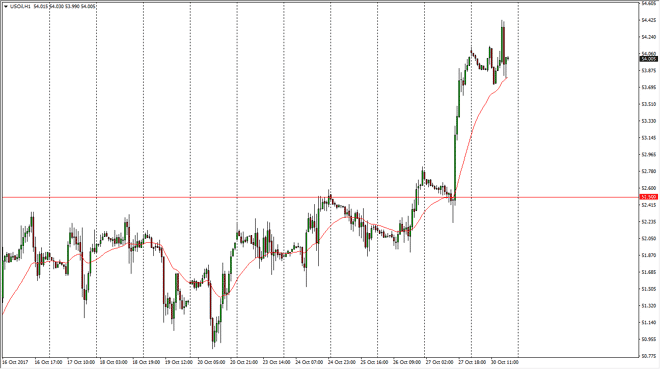

Crude Oil Price Forecast October 31, 2017, Technical Analysis

Updated: Oct 31, 2017, 05:23 GMT+00:00

WTI Crude Oil The WTI Crude Oil market continues to be very volatile, as we sliced around the $54 region. The $55 level above is massively resistive, and

WTI Crude Oil

The WTI Crude Oil market continues to be very volatile, as we sliced around the $54 region. The $55 level above is massively resistive, and I think that pullbacks should continue to offer value. The $52.50 level underneath should be support, and I believe that it’s only a matter of time before the buyers get involved and pick up on value. Ultimately, if we break above the $55 level, the market should then go to the $57.50 level above, perhaps even the $60 handle. If we were to break down below the $52.50 level, the market should then go to the $50 level after that. Ultimately, there is a lot of volatility, and of course a lot of issues when it comes to crude oil. Right now though, it seems as if hedge funds are willing to put money into this market.

Crude Oil Video 31.10.17

Brent

Brent markets went back and forth during the day as well, showing signs of support just above the $60 handle. If that’s being the case, the market could bounce from here and continue the overall upward pressure, as breaking above the $60 level was significant. I think the $62.50 level above is the target, but if we were to break down below the $60 level, it’s likely that the $58.50 level underneath is going to be the next target. I think we will see a lot of volatility, but breaking above the $60 level is a bullish sign, and I think that we should continue to see a lot of interest to the upside. Pay attention to the US dollar, because if it starts to sell off suddenly, that could be very bullish for Brent as well. The noise in this in this market could very well continue.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement