Advertisement

Advertisement

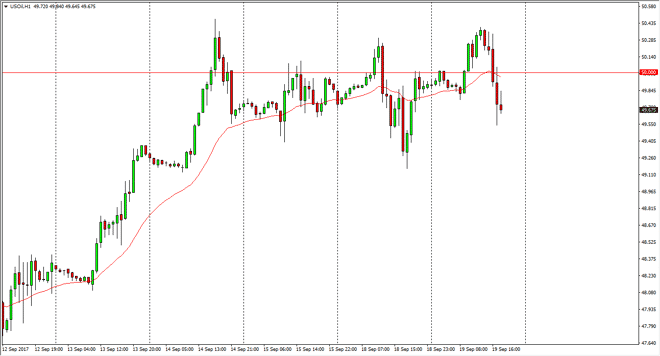

Crude Oil Price Forecast September 20, 2017, Technical Analysis

Updated: Sep 20, 2017, 04:47 GMT+00:00

WTI Crude Oil The WTI Crude Oil market went sideways initially on Tuesday, but then broke above the $50 level. Later in the day, we pulled back but I

WTI Crude Oil

The WTI Crude Oil market went sideways initially on Tuesday, but then broke above the $50 level. Later in the day, we pulled back but I think that today could be a very volatile session in the crude oil market. We are currently still in consolidation as we dance around the $50 level, and that being the case it’s likely that the Federal Reserve will decide where we go next in the form of the statement. What I mean by this is that if the Federal Reserve looks to be a bit dovish, that could drive down the value the US dollar and thereby bring the value of oil higher. At the same time, we have the Crude Oil Inventories announcement, so I expect to see a lot of noise today. Quite frankly, it’s probably easier to wait for an impulsive move and see where the market closes at the end of the day to make your decision.

Oil Forecast Video 20.9.17

Brent

Brent fell and tested the $55 level underneath during the session on Tuesday, an area that has been supportive recently. It’s likely that we could bounce from here, but again I believe that we won’t need to wait to see what happens over the next 24 hours a get some clarity. This could be one of the more important sessions for crude oil, and of course that will be any different in Brent as it is in the WTI market. I think that the market is likely to be very choppy, but I think that clarity is coming relatively soon as the liquidity pics of, and of course we get a bit of clarity when it comes to the underlying greenback as well. Ultimately, this is a market that needs to decide soon.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement