Advertisement

Advertisement

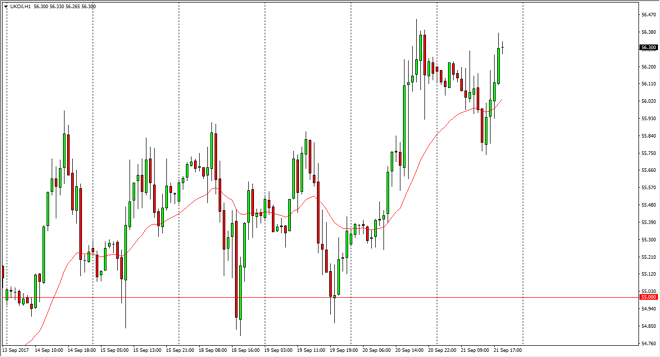

Crude Oil Price Forecast September 22, 2017, Technical Analysis

Updated: Sep 22, 2017, 06:48 GMT+00:00

WTI Crude Oil The WTI Crude Oil market has been very volatile during the session on Thursday, falling towards the $50 level but finding plenty of buying

WTI Crude Oil

The WTI Crude Oil market has been very volatile during the session on Thursday, falling towards the $50 level but finding plenty of buying in that area. By bouncing from there, it shows that we continue to see a lot of volatility in this market, and if we can break above the $51 level, that would be a continuation of the overall uptrend. Ultimately, if we were to break down below the $49 level, that would be a very bearish sign. Ultimately, this is a market that probably goes back and forth until we get one of those moves, and therefore is can be very difficult to place any real faith in a trade, and I think that short-term choppiness and scalping should be what we can expect in this market.

Crude Oil Forecast Video 22.9.17

Brent

Brent markets did very much the same, falling down towards the $55.75 level but bouncing back to wipeout most of the losses. If we can break above the $56.50 level, I think that the market can continue to go higher. At that point, I would anticipate the market looking towards the $57.50 level which has been a short-term resistance barrier. A break above there should send this market to the $60 handle, and ultimately, I think that the volatility should continue. I think if we pull back from here, we could drop as low as $55 without breaking the overall bullish pressure but right now looks as if the market is still trying to figure out what to do, and this is the realm of scalpers and not traders. Investing is all but impossible, because quite frankly the volatility is probably going to get worse before it gets better. Noisy markets would be one phrase that I would use to describe oil.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement