Advertisement

Advertisement

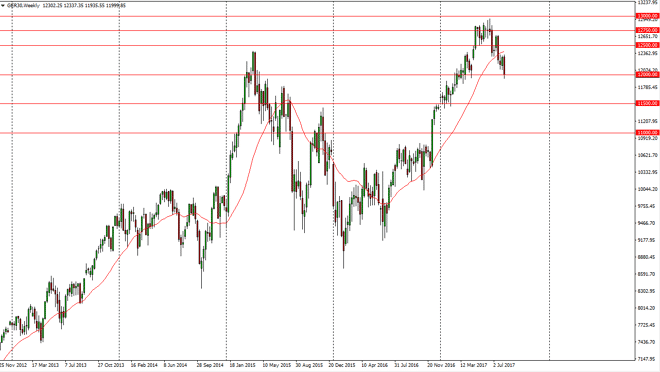

DAX forecast for the week of August 14, 2017, Technical Analysis

Published: Aug 12, 2017, 04:37 GMT+00:00

The German index fell during a majority of the week, testing the €12,000 level. This is an area that I think is much more important than most areas, and a

The German index fell during a majority of the week, testing the €12,000 level. This is an area that I think is much more important than most areas, and a breakdown below the bottom of the weekly candle should be negative and send this market looking towards the €11,500 level. Ultimately, that area should be even more supportive. I think that a breakdown to that level is very possible, mainly because the EUR/USD pair continues to show resiliency and strength. As this happens, it makes German exports very expensive, and therefore weighs upon the DAX. I don’t necessarily think that we are heading for some type of melt down, just that we are certainly pulling back at this point.

I believe that the €11,500 level will be even more supportive than the €12,000 level, and should attract a lot of attention. It will be interesting to see how the currency markets affect this index, because part of the reason that the EUR is rallying is that the European Union is starting to show signs of strength again. Ultimately, I think the buyers will come back due to this fact, and that the currency headwinds will be a minor issue over the longer term.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement