Advertisement

Advertisement

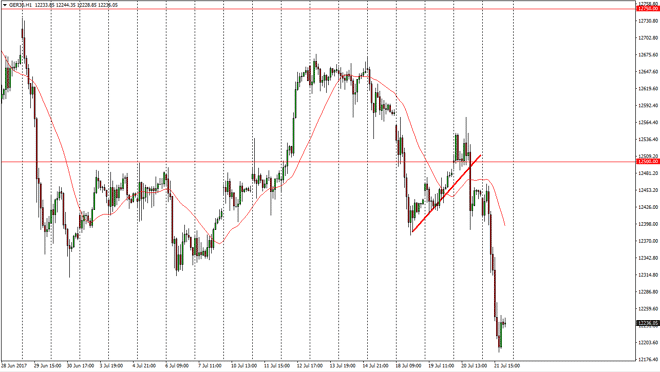

DAX Index Forecast July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:04 GMT+00:00

The German index fell rather significantly during the day on Friday, as the EUR/USD pair continues to show signs of strength. This puts a lot of concern

The German index fell rather significantly during the day on Friday, as the EUR/USD pair continues to show signs of strength. This puts a lot of concern in the market about the possibility of German exports being too expensive for the people to buy, and that will continue to weigh upon the DAX. However, I think that the real bottom of support is probably closer to the €12,000 level, so it’s not until we break down below there that I’m comfortable with selling longer term. I believe that we could try to find a bottom, but in the meantime, we are likely to sell off short-term rallies for short-term moves. I would not look for anything more than that though, and I think that the volatility is short-lived. Eventually the EUR/USD pair will have to pull back, and what’s it does this market will rally. The real fight will begin at the €12,500 level, and a break above there should send this market much higher.

Brexit

There is also the effect of the negotiations between the European Union and the United Kingdom, and what it does to the currency markets. Because of this, paying attention to headlines will be part of the job of anybody trading the DAX, as we will more than likely have sudden moves in one direction or the other. Ultimately, I think that this is a market it’s very difficult to deal with, but as long as we stay above the €12,000 level, I believe that it is probably going to be bullish given enough time. Expect choppiness, but I think we are essentially getting rid of a lot of “weak hands.”

DAX Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement