Advertisement

Advertisement

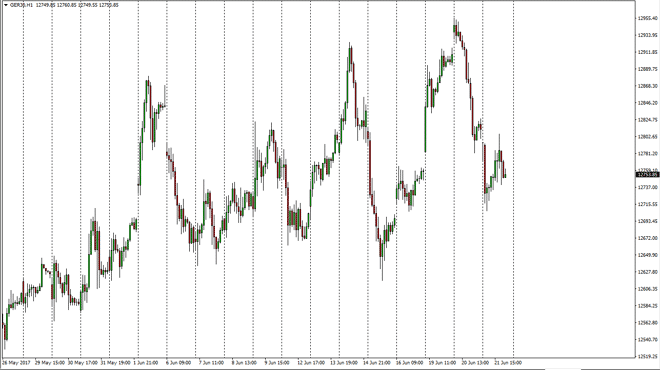

DAX Index Forecast June 22, 2017, Technical Analysis

Updated: Jun 22, 2017, 04:44 GMT+00:00

The German index gapped lower at the open on Wednesday, but then fell all the way down to a previous gap near the €12,700 level. We bounced from there,

The German index gapped lower at the open on Wednesday, but then fell all the way down to a previous gap near the €12,700 level. We bounced from there, and then found a significant amount of resistance at the open for the session, so rolling over from there is and that surprising. We continue to go back and forth, and with this being the case it’s likely that the market will drop a bit from here, looking for support at the €12,600 level. Having said that, we have made several highs in a row, so it’s likely that the market will continue to go higher over the longer-term. Stock markets are starting to fall a bit though, and with that being the case it’s very possible that the DAX will roll over right along with what we have been seen late in the US session.

EUR/USD

The EUR/USD pair of course has an effect on this market, so if the money is running away from Europe, it runs away from DAX trades as well. Ultimately, if we see the risk appetite return to the marketplace, I think that the DAX will be one of the first places that rallies, due to the market preferring German exports over anything else in the European Union. I think that the market continues to be one that is volatile, but certainly there are a lot of reasons to think that when we get a bit of a recovery, the German market will be the first place that money goes to.

If we do breakdown, it’s likely that we will see the market reach towards the €12,000 level, longer-term of course, as it is a massive support and essentially the bottom of the uptrend as far as I can see.

DAX Video 22.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement