Advertisement

Advertisement

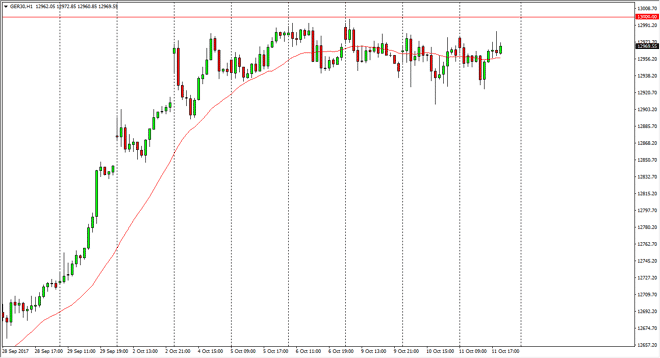

DAX Index Forecast October 12, 2017, Technical Analysis

Updated: Oct 12, 2017, 04:56 GMT+00:00

The German index pulled back a little bit during the day on Wednesday, but found enough support at the €12,900 level to turn things around and bounce. I

The German index pulled back a little bit during the day on Wednesday, but found enough support at the €12,900 level to turn things around and bounce. I think that the €13,000 level above is resistance, and eventually we could breakout above there and continue to go much higher. Ultimately, this is a market that has shown so much resistance at that area that I think that the market should continue to go higher once we break that level as it should release a lot of momentum. The €13,000 level should continue to offer plenty of support and essentially the “floor” in the market longer term. At that point, I’m more than willing to buy dips as the DAX should be free to go much higher. Having said that, it’s very difficult to go long of this market until we get a breakout, so therefore you can put a buy stop above the €13,000 level and simply wait for the break out.

With the recent support that we have seen, I do think that we breakout given enough time, but I also think that a breakdown to a fresh, new low would be very negative, and perhaps signal something even more drastic is about to happen. Nonetheless, with all of the bullish pressure that we have seen as of late, I think it’s only a matter of time before we continue the upward trend as it would signify that the next leg up has just started. The German index of course is the mainstay when it comes to the European Union, and that means that as long as the EU is doing well, the DAX should as well as it is where money goes to first when people are trying to invest in the European continent.

DAX Video 12.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement