Advertisement

Advertisement

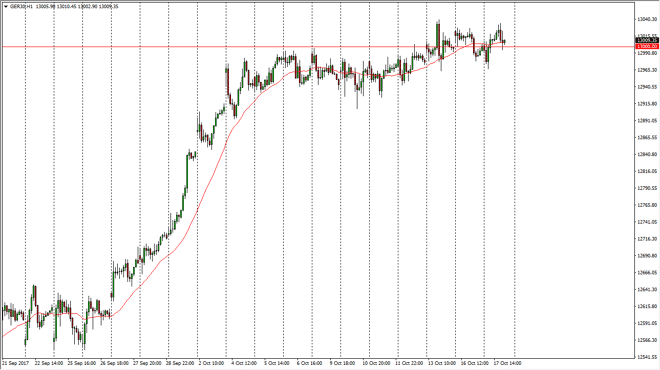

DAX Index Forecast October 18, 2017, Technical Analysis

Updated: Oct 18, 2017, 04:57 GMT+00:00

The German index rallied a bit during the course of the day on Thursday, breaking above the €13,000 level. However, we found enough support underneath on

The German index rallied a bit during the course of the day on Thursday, breaking above the €13,000 level. However, we found enough support underneath on the pullback to keep the market afloat, and I believe that the market should continue to be choppy, yet positive overall. The German economy is by far the strongest in the European Union, and it is continuing to look healthy overall, so I believe that the DAX will continue to be a leader when it comes to stock markets around the world. In fact, the attitude of the DAX not only helps other European indices, but it even gives the US markets a bit of a boost every day that rallies. Because of this, the DAX is one of the biggest and most important markets that I follow, and currently it looks as if we are simply content to trying to build up enough momentum to break above the 13,000 level for good.

The 24 hour exponential moving average is turning up slightly, and I think that’s probably the main take away here: that we are going to grind our way to the upside, and eventually break out and above to fresh, new highs. Ultimately, the market will probably go looking towards the €13,250 level above, but it’s going to be choppy on the way up. Add slowly on the dips, as we continue to see the choppiness offer plenty of opportunities. I think that longer-term, there is a bit of a “floor” at the €12,900 level. The market continues to look healthy, but the recent run-up to this level shows that we need to perhaps build up the momentum to continue. I think that’s what we’re doing right now, and eventually this will be looked at as an opportunity to go long.

DAX Video 18.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement