Advertisement

Advertisement

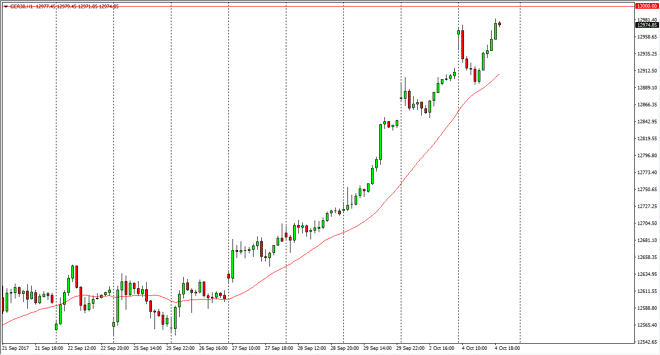

DAX Index Forecast October 5, 2017, Technical Analysis

Updated: Oct 5, 2017, 05:34 GMT+00:00

The German index initially gapped higher at the open on Wednesday, came back to fill the gap at the €12,900 level, and then shot towards €13,000 again. I

The German index initially gapped higher at the open on Wednesday, came back to fill the gap at the €12,900 level, and then shot towards €13,000 again. I believe that the €13,000 level will be a bit of the psychological barrier, but given enough time we should continue to go much higher, perhaps offering an opportunity to buy-and-hold. In the meantime, I look at dips as value, as I believe most of the trading world does currently. The DAX has been very strong for some time, and of course leads the rest of the European Union as Germany is the largest and most successful European economy. If you are an American trader, you can think of the DAX as the Dow Jones Industrial Average for the European Union. It is the blue-chip index if you will.

I like buying dips, and I believe that it’s only a matter of time before we not only break above the 13,000 level, but eventually go looking towards the 15,000 level longer term. I think that there is a massive amount of support at the 12,800 level, and perhaps even at the 12,750 level. Ultimately, this is a market that continues to see buyers jump in based upon value, as it looks like the stock markets around the world can only go in one direction, higher. The DAX of course has been leading the way for the American indices as well, so quite frankly this is a market that should be paid attention to even if you don’t trade it directly. If you don’t, you are probably missing out, as the DAX has been so massively bullish. I would not be surprised at all to see a little bit of consolidation in this region though, as we may have to build momentum to finally clear the barrier.

DAX Video 05.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement