Advertisement

Advertisement

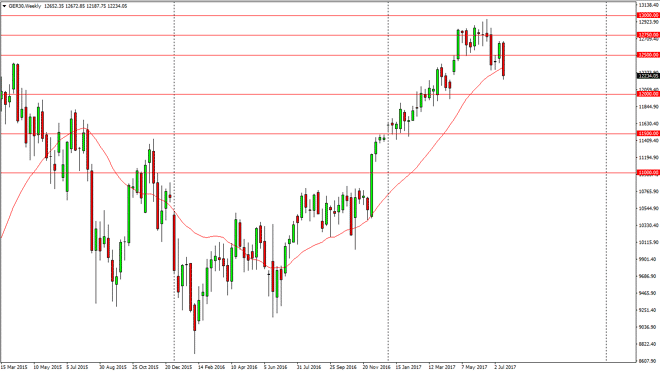

DAX Index forecast for the week of July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:43 GMT+00:00

The German index fell significantly during the week, slicing through the €12,500 level. Not only that, we are testing a significant area of that appears

The German index fell significantly during the week, slicing through the €12,500 level. Not only that, we are testing a significant area of that appears on the chart from several weeks ago. The gap in that area should send this market looking for support, and we have filled the gap, so it’s likely that buyers might be interested in. Alternately, if we were to break below the €12,000 level, that point I think that the uptrend is over, at least for the time being. One of the biggest bearish pressures in this market is going to be the EUR/USD currency pair, as it makes the German exports very expensive, which of course is a major factor in the DAX itself.

Consolidation?

I suspect that we may find ourselves in a period of consolidation going forward. The market is likely to chop around as we look for direction, and of course people will be concerned about the currency headwinds. Because of this, the market should then go looking towards the €13,000 level. The markets have been very rocky as of late, but I think that the buyers are still very much interested in this market, although the sudden strength of the euro does have people worried. If we do breakdown below the €12,000 level, I suspect that we will then go looking for the €11,500 level, and then eventually the €11,000 level. Either way, I suspect that were going to get choppiness rather soon, so therefore I would not look for any type of easy trade ahead of you. Longer-term though, we are most certainly seen more reaction to the upside, but we are also getting a bit overextended. Because of these questions, I suspect that this market is going to be very difficult for longer-term traders.

DAX Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement