Advertisement

Advertisement

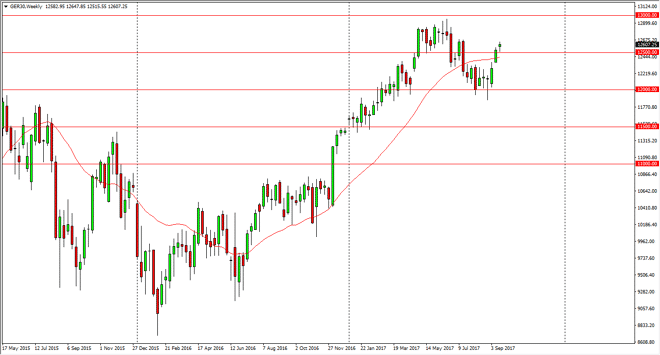

DAX Index forecast for the week of September 25, 2017, Technical Analysis

Updated: Sep 23, 2017, 07:10 GMT+00:00

The German index gapped higher at the open on Monday, but then pulled back to test the €12,500 level. This is an area that should offer support, and it

The German index gapped higher at the open on Monday, but then pulled back to test the €12,500 level. This is an area that should offer support, and it has. The resulting weekly candle was a hammer, and that shows that the buyers are still around. I think that a break above the top of the weekly candle should signal that we will continue to go higher. I believe that the market should go looking for the €13,000 level, and I believe the dips are buying opportunities. I have no interest in trying to fight the uptrend, I believe that the DAX will continue to lead the way for the rest of the European Union. The DAX tends to be the blue-chip stock index for the EU, and as the EU economic Outlook has been strengthening, makes sense of the DAX will as well. Pay attention to the EUR/USD pair, as it does have an influence on where this market goes, as it strengthens, it makes exports more expensive coming out of Germany. Alternately though, I think that the €12,000 level has offered a bit of a floor in this market, and should continue to attract buying pressure.

If we do break down below the €12,000 level, the market will more than likely go looking towards the €11,500 after that as it should be recognized as a previous resistance barrier. Either way, I do believe that the buyers will have their way, and once we clear the €13,000 level, it is a move to the €15,000 level that will happen next. I have no interest in shorting this market anytime soon as we have seen such a reliable uptrend over the last 2 years in Germany, and once the elections are out of the way it should give more confidence.

DAX Video 25.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement