Advertisement

Advertisement

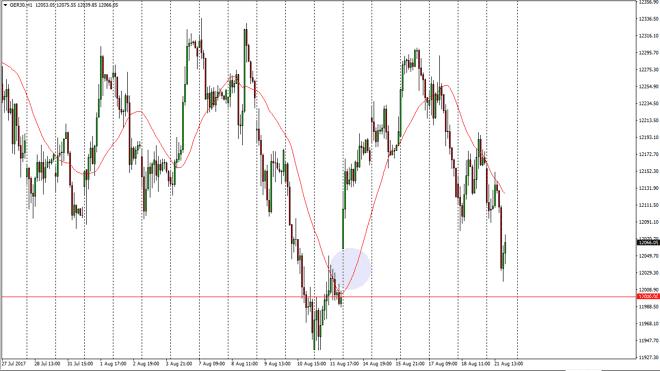

DAX Index Price Forecast August 22, 2017, Technical Analysis

Updated: Aug 22, 2017, 05:45 GMT+00:00

The German index initially tried to rally on Monday, but then fell from the €12,500 level to reach towards the €12,000 level underneath. The reason that

The German index initially tried to rally on Monday, but then fell from the €12,500 level to reach towards the €12,000 level underneath. The reason that the market is so interesting at this level is that there was a massive gap from the €12,000 level about a week ago, and it suggests that the markets will find some type of support in this area. Ultimately, if we can rally from here, then I think the market goes looking towards the €12,300 level next. If we were to break down below the €11,925 level, the market should then break down significantly. The DAX is highly influential for other European indices as well, so if you trade an index that we don’t cover here at FX Empire, you should pay attention to the DAX for those markets also. It is essentially the “blue-chip” index for the EU.

Value?

The question now is whether there is value at this level. I personally believe there is, but the €11,925 level is essentially my “bailout point” if the market goes against me. I think it might be difficult to break above the €12,300 level, so therefore I am looking at this as more of a short-term buying opportunity, but I do recognize that a move above there should continue the longer-term uptrend. The DAX has been a bit shaky as of late, and part of that might be the resurgence of the EUR/USD pair, which makes German exports expensive. However, the reason that the pair has gone higher is that the European Central Bank suggests that the European Union economy is stable enough to deal with higher interest rates. If that’s the case, longer-term profits should continue to be a driver of the DAX to the upside.

DAX Video 22.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement