Advertisement

Advertisement

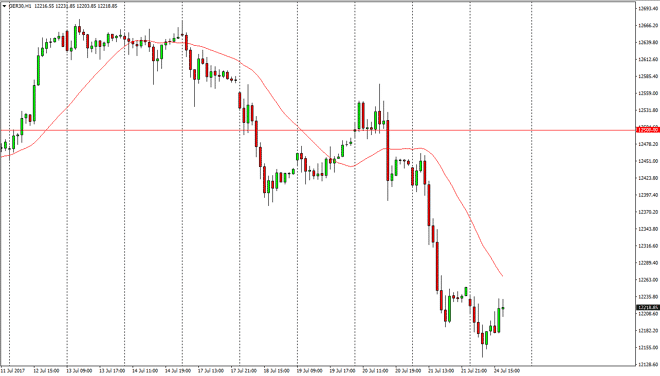

DAX Index Price Forecast July 25, 2017, Technical Analysis

Updated: Jul 25, 2017, 04:16 GMT+00:00

The German index fell initially during the day on Monday, but found enough support to bounce again. However, we are starting to see selling pressure again

The German index fell initially during the day on Monday, but found enough support to bounce again. However, we are starting to see selling pressure again and it looks as if we’re going to chop around with a negative bias. There is a massive amount of support near the €12,000 level, and a breakdown below there would destroy the uptrend that we have been enjoying for some time. I think that short-term rallies will more than likely offer selling opportunities, and I would not be convinced of buying this market until we break above the €12,500 level, or perhaps get some type of supportive daily candle. In the meantime, short-term traders should continue to punish this market, especially as the EUR/USD pair continues to rally longer term.

Following the EUR/USD

I believe in following the EUR/USD pair, as the more expensive euro will be especially negative for the DAX as German exports are a huge part of this index. There is a pricing of monetary tightening in the currency markets, and that is starting to work its way through the stock markets. I believe that the €12,000 level will be a massive barrier though, so I don’t think it will be easy for the market to break below there. However, if it does it will be a very negative sign, and should send this market much lower. In fact, that could be the beginning of a bearish trend that really takes hold at that point. It’s going to be noisy, but I think short-term we have sellers, but longer-term we may make a significant stand closer to the €12,000 level. Small trading positions are recommended as this is going to be a very choppy and indecisive market, as currency markets are starting to become even more volatile than usual.

DAX Video 25.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement