Advertisement

Advertisement

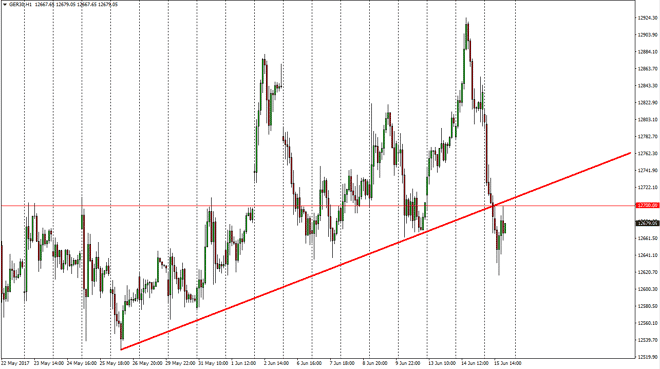

DAX Index Price Forecast June 16, 2017, Technical Analysis

Updated: Jun 16, 2017, 04:21 GMT+00:00

The German index broke down significantly during the course of the session on Thursday, slicing below a significant uptrend line and the €12,700 level at

The German index broke down significantly during the course of the session on Thursday, slicing below a significant uptrend line and the €12,700 level at the same time. Because of this, I believe that the market may be looking to break down a little bit further, however, it’s likely that the market will be volatile. If we can break above the €12,750 level, the market should find plenty of buyers, reaching towards the €12,900 handle. Ultimately, the market should find plenty of buyers, but we need to break out above that level before. On the other, if we breakdown below the recent lows, then the market can go much lower I will use the €12,600 level as a trigger to start selling.

Ultimately, volatility could be your friend.

I believe that the volatility that we are about to see in the DAX will continue to offer trading opportunities given enough time. The breakdown during the day was somewhat significant, but if we were to break above the €12,750 level, it would not only show a breakdown, but it would show a complete turnaround in momentum and could get the markets running much higher. The DAX has been a leader in the European Union over the longer-term, and I think that will continue to be the case as long as the European Union stock indices attract money. The DAX is always where he goes to first, as Germany is one of the more reliable economies on the continent.

On the other hand, if the European Union is starting to fall apart, that will show itself in the DAX initially. So having said that, it is a good bellwether for what happens next in other indices such as the AEX, CAC, and MIB.

DAX Video 16.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement