Advertisement

Advertisement

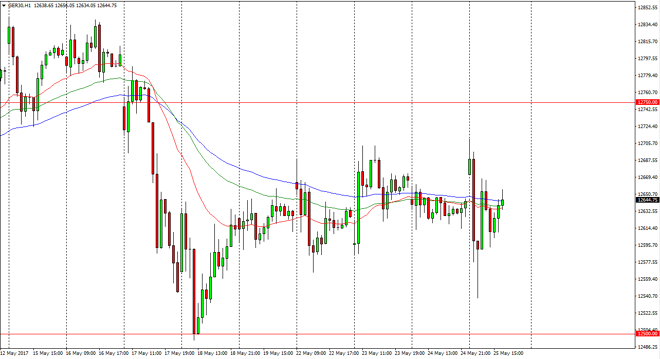

DAX Index Price Forecast May 26, 2017, Technical Analysis

Updated: May 26, 2017, 04:06 GMT+00:00

The German index initially gapped higher at the open on Thursday, reached towards the €12,700 level, and then turned around to roll over and reach towards

The German index initially gapped higher at the open on Thursday, reached towards the €12,700 level, and then turned around to roll over and reach towards the €12,550 level. We bounced from there, and then reached towards opening somewhat unchanged. The DAX has been relatively flat over the last several sessions, so this seems as if it is simply an extension of what we have seen over the last week or so. I believe that the €12,500 level underneath continues to offer support, so it’s not until we break down below there that I would be concerned about the recent uptrend. Yes, we did sell off drastically last week, but that had more to do with noise coming out of Washington DC than anything else. In the long run, that should not have much of an effect on what happens in Germany.

Patience will be needed

I believe that you will have to be extraordinarily patient on the way up, as although I believe in the longer-term uptrend, we have hit a bit of a wall as of late. That tends to be something that you will see what a market is trying to build up larger positions. This is what is known as an “accumulation phase”, and I believe that the so-called smart money is starting to build up a larger position that they will hang onto for the larger move. Certainly, the DAX has been a strong performer as of the last several months, and the recent flat action in this market doesn’t change that from a longer-term perspective. Because of that, I am a buyer and not a seller and believe that dips will continue to attract larger traders that will eventually push this market higher, as we have seen in the stock markets in America.

DAX Video 26.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement