Advertisement

Advertisement

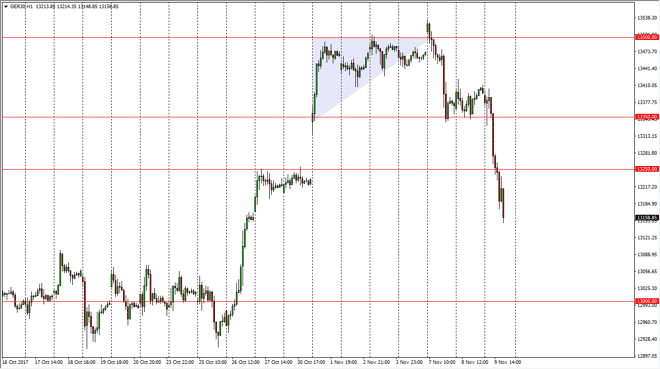

DAX Index Price Forecast November 10, 2017, Technical Analysis

Updated: Nov 10, 2017, 04:35 GMT+00:00

The German index fell significantly during the trading session on Thursday, slicing through not only the €13,350 level, but also the bottom of the gap at

The German index fell significantly during the trading session on Thursday, slicing through not only the €13,350 level, but also the bottom of the gap at the €13,250 level. That’s a very negative sign, and I think we are going to go looking for support at the next major level, the €13,000 handle. Any type of support for bounce from there could be a nice buying opportunity, but I would wait for daily candle to give us an idea as to start going long. That being said, the EUR/USD pair of course is going to have its influence as per usual, as a cheaper Euro has a strong influence on the cost of German exports. As the Euro falls, it’s likely that the DAX will rally, least that’s normally the correlation. Because of this, I believe that the smart trading public is sitting on the sidelines, simply allowing this to happen, and looking to pick up the pieces. Ultimately, we are still very much in an uptrend, and that has not changed.

I think that the €13,500 level above will be targeted, and although it may take some time to get there, I am not surprised at all if we get there within the next couple of weeks. Remember, markets tend to climb a wall of worry, and take the elevator down. I think that’s what we’re seeing here, people willing to take profits after large moves, at the slightest scent of trouble. If we were to break down below the €13,000 level, then I would need to step to the side and await a longer-term signal, perhaps on the weekly charts. However, I suspect that the buyers are a lot closer than many people think currently. I suspect this could be a nice value play just waiting to happen.

DAX Video 10.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement