Advertisement

Advertisement

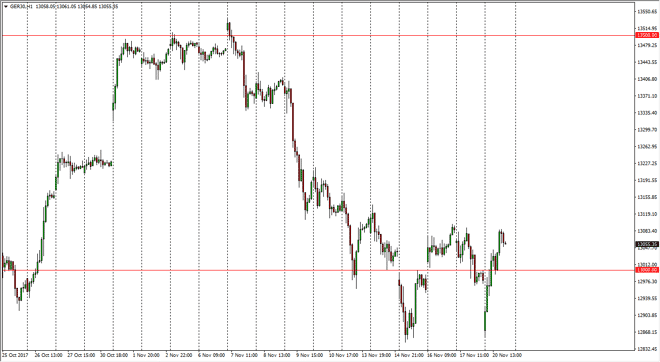

DAX Index Price Forecast November 21, 2017, Technical Analysis

Updated: Nov 21, 2017, 05:05 GMT+00:00

The German index gapped lower at the open on Monday, reaching down towards the €12,850 level. We bounce from there, and even sliced through the gap,

The German index gapped lower at the open on Monday, reaching down towards the €12,850 level. We bounce from there, and even sliced through the gap, slicing above the €13,000 level. I think that we are trying to go higher, perhaps once we break above the €13,100 level, I would be willing to put money back into the DAX, as we should go higher, perhaps looking towards the €13,500 level after that. I think regardless of what happens next, we are going to see a lot of choppiness as the situation in the European Union is a bit fluid. We are starting to see the ECB talk about extending quantitative easing, but at a slower rate. Because of that, it gives a bit of a boost for the DAX, as it keeps German exports cheaper. However, stock markets in general around the world are a bit frothy, so it’s likely that the DAX will be a bit tenuous because of that.

Looking at this chart, I think we are essentially going to be range bound, at least for the short term. I think that the €13,000 level is essentially “fair value”, least in the short term. If we do breakout to the upside, the market should go much higher, and make an attempt at the €13,500 barrier above. If we can clear there, then the longer-term uptrend is ready to continue. However, I would not be surprised at all to see a significant pullback, and quite frankly it would be a very welcome site for longer-term buyers as it offers value to traders who may have missed the rally. Regardless what happens next, it’s going to be very choppy and volatile. All things being equal though, I believe that the buyers will probably have their way.

DAX Video 21.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement