Advertisement

Advertisement

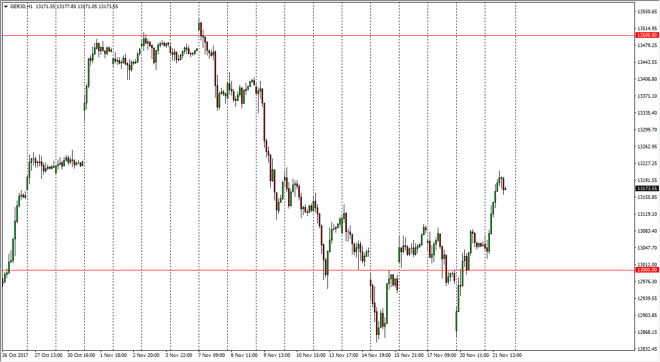

DAX Index Price Forecast November 22, 2017, Technical Analysis

Updated: Nov 22, 2017, 05:19 GMT+00:00

The German index rallied significantly during the trading session on Tuesday, breaking towards the €13,200 level. I think we are now going to see buyers

The German index rallied significantly during the trading session on Tuesday, breaking towards the €13,200 level. I think we are now going to see buyers jumping into this market, and that short-term pullback should be buying opportunities. The 13,000 level has seen a lot of interest in the past, and I think it will continue to show as much going into the future. This will essentially be the “floor” of the market, and that it’s only a matter of time before buyers jump in on dips. With that being the case, I think that the market should then go to the €13,500 level above there. Ultimately, short-term pullbacks continue to offer value that plenty of traders will be willing to take advantage of as we have seen such an impulsive move to the upside from a couple of days ago.

Keep in mind that the failure of the German government to form a coalition had a negative influence on the market and the short-term, but people bought that overreaction for the value that it was. Although I think is can be very noisy, I believe that the market should continue to be one that favors the upside, and eventually breaks out above the €13,500 level, extending to the €13,750 level. In general, I think that the EUR/USD plays a significant amount of influence on the market as well, as the economic outlook for the European Union. Right now, I believe that we are going to continue to go higher, and therefore I do like the idea of buying in small increments and simply adding as we go along. That is an excellent way to build up a larger position awaiting the longer-term move to the upside and a significant move that attracts a lot of “buy-and-hold” traders.

DAX Video 22.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement