Advertisement

Advertisement

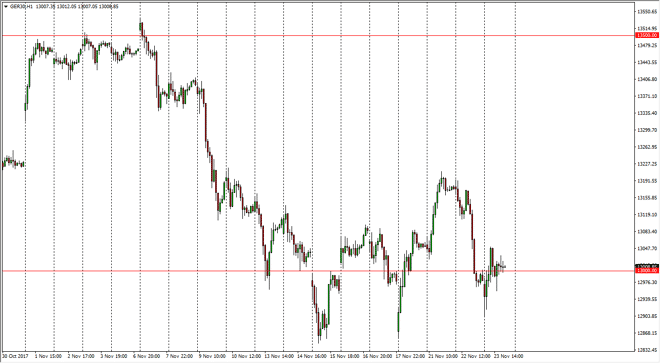

DAX Index Price Forecast November 24, 2017, Technical Analysis

Updated: Nov 24, 2017, 05:06 GMT+00:00

The German index has gone back and forth during the course of the session on Thursday, as we dance around the €13,000 level I believe the market is trying

The German index has gone back and forth during the course of the session on Thursday, as we dance around the €13,000 level I believe the market is trying to form a bit of a base here, and the fact that the most recent pullback was a little less extreme than the previous 2 pullbacks, tells me that the buyers are starting to make a bit of a stand. I believe that if we can break out to the upside, the market will go looking towards the €13,200 level, and then eventually the €13,500 level after that. I like the idea of buying dips in the DAX, as it offers value and what I think is one of the premier markets right now. Obviously, as Germany goes, so does Europe. This is one of the main drivers of buying the DAX, as it is a belief in the European Union being expressed through financial instruments.

The EUR has rallied a bit, but even with more expensive German exports it makes sense that the DAX would rally, because quite frankly the European economy seems to be strengthening, as well as having extended quantitative easing coming out of the ECB, allowing that easy money to flow into the stock markets. Eventually, I expect that we will break above the €13,500 level, and go looking towards the €14,000 level after that. I don’t have any interest whatsoever and trying to short this market unless of course we were to break down below the €12,750 level underneath, which is a sign of significant weakness. Overall, I believe that the DAX will continue to offer plenty of buying opportunities on short-term debts, allowing someone to build a large position. In general, I expect volatility, but with an upward bias.

DAX Video 24.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement